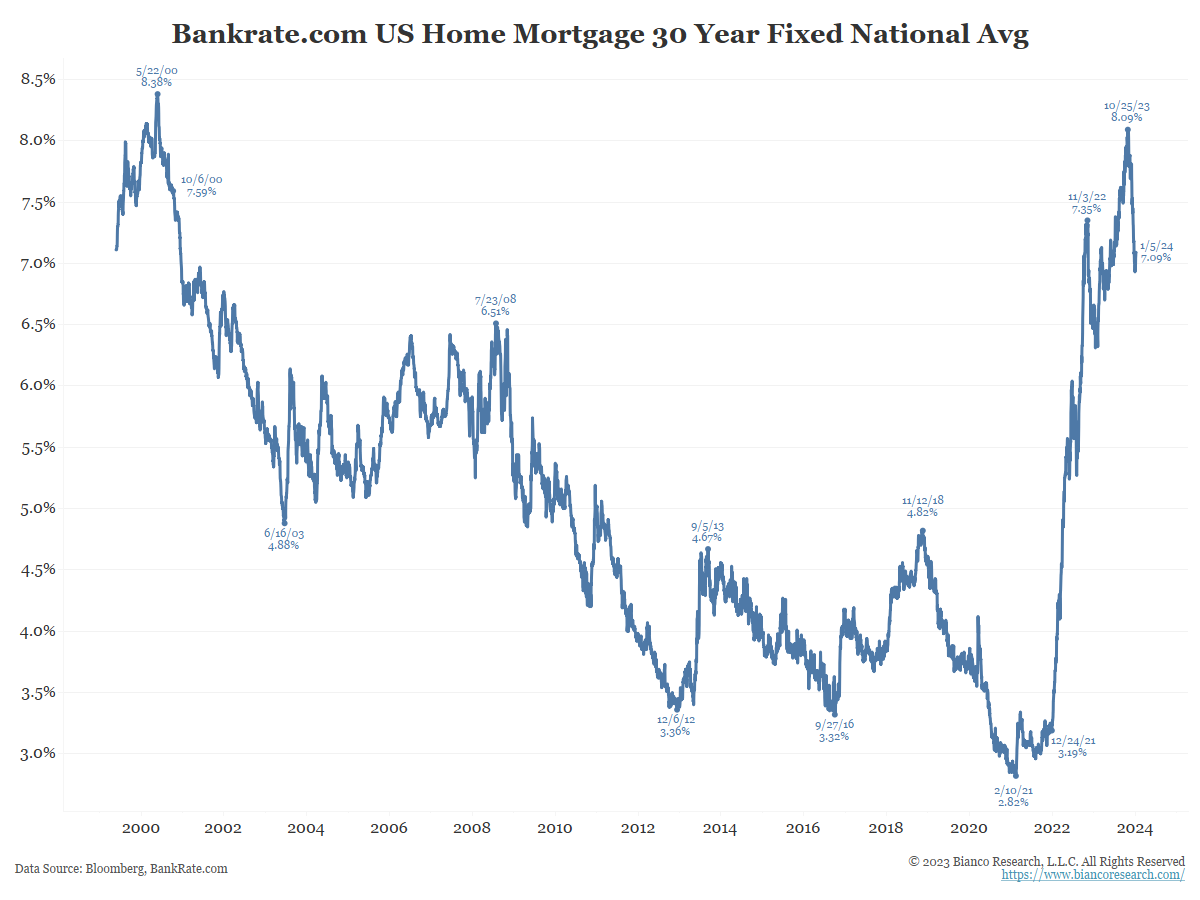

2023 was not a good year for real estate. The main reason was rising mortgage rates, as this chart of conventional residential mortgage rates shows.

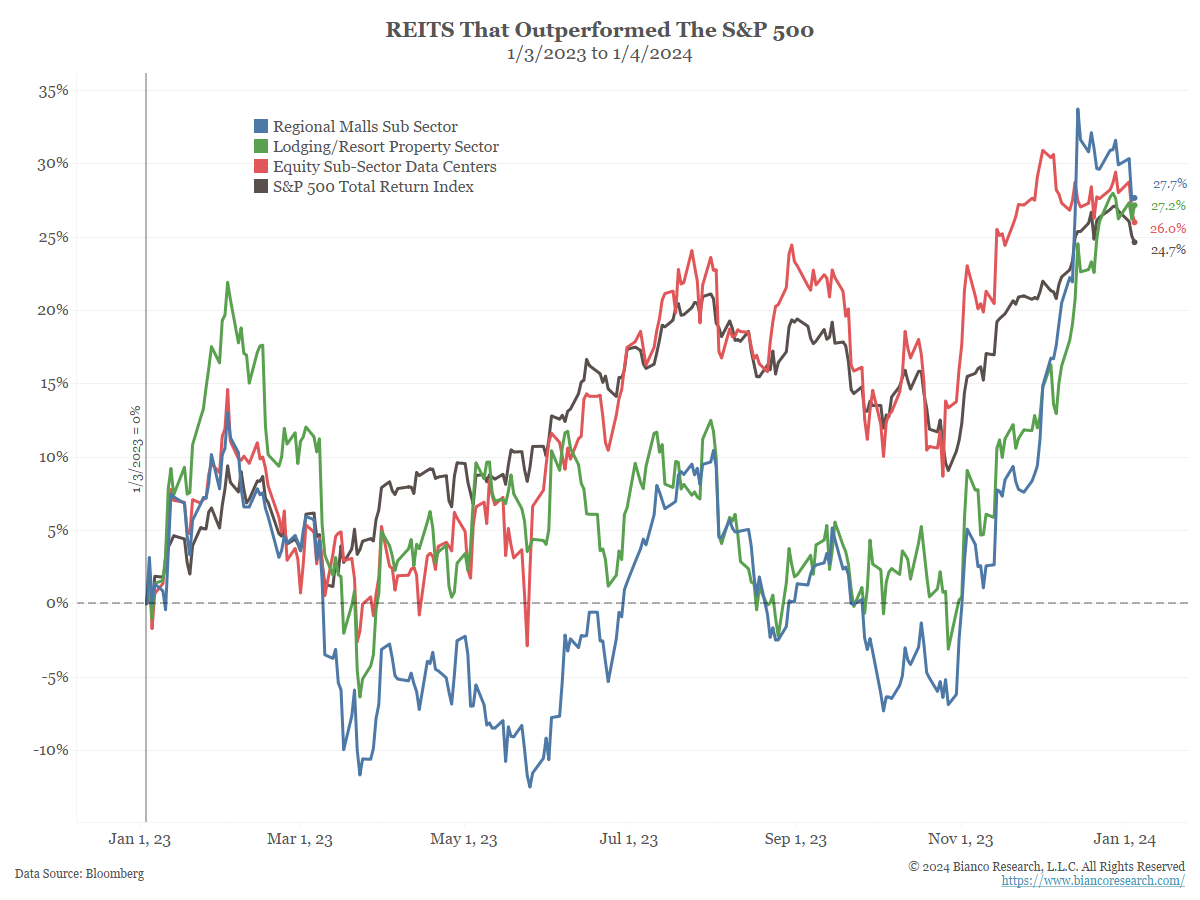

Given this headwind, we look at how the US real estate market sectors did. To accomplish this, we looked at the total return of various Real Estate Investment Trust (REIT) sectors compared to the total return of the S&P 500 (black line in all the charts below).

The Best

Only a handful of REITs have outperformed the 24.7% S&P 500 since the beginning of last year. They include:

- Regional malls at 27.7% (blue)

- Lodging and resort at 27.2% (green)

- Data centers at 26.0% (red)

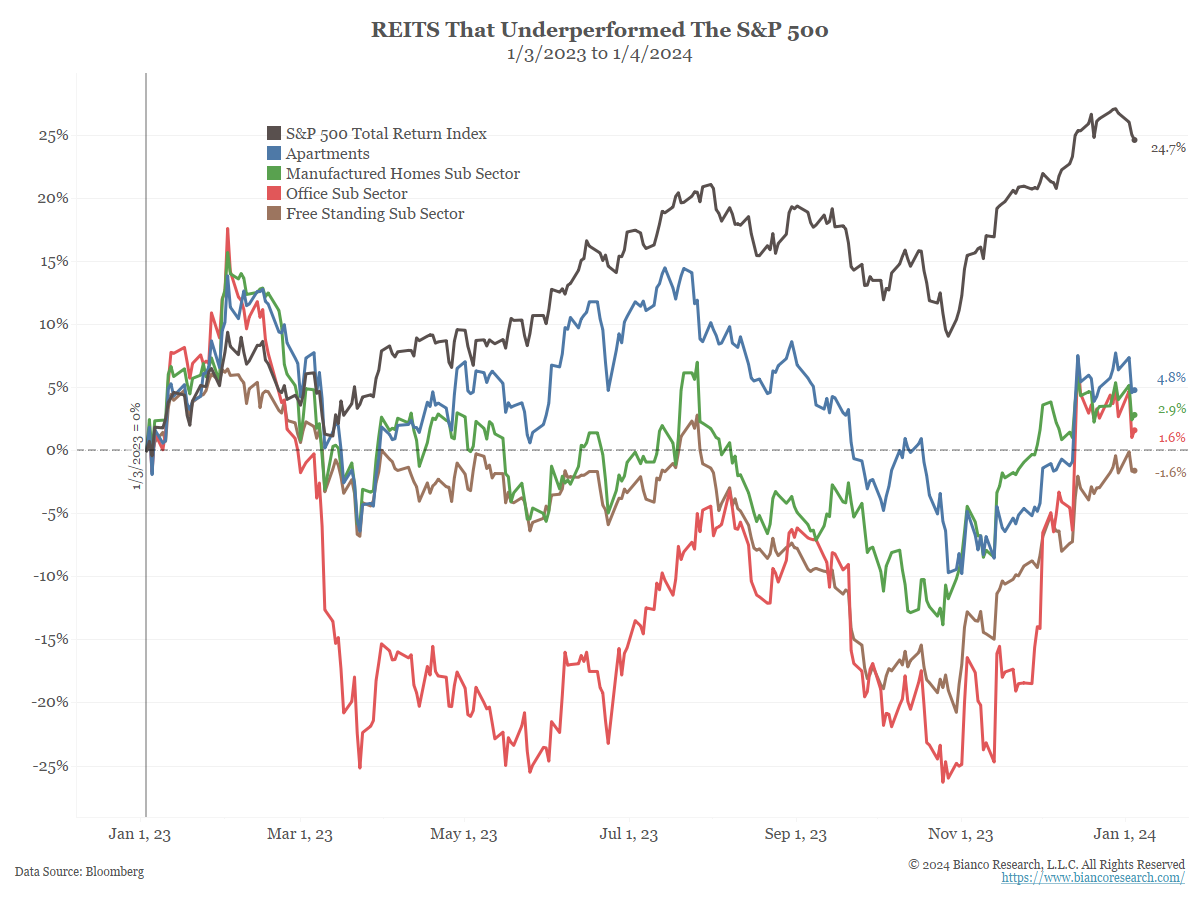

The Worst

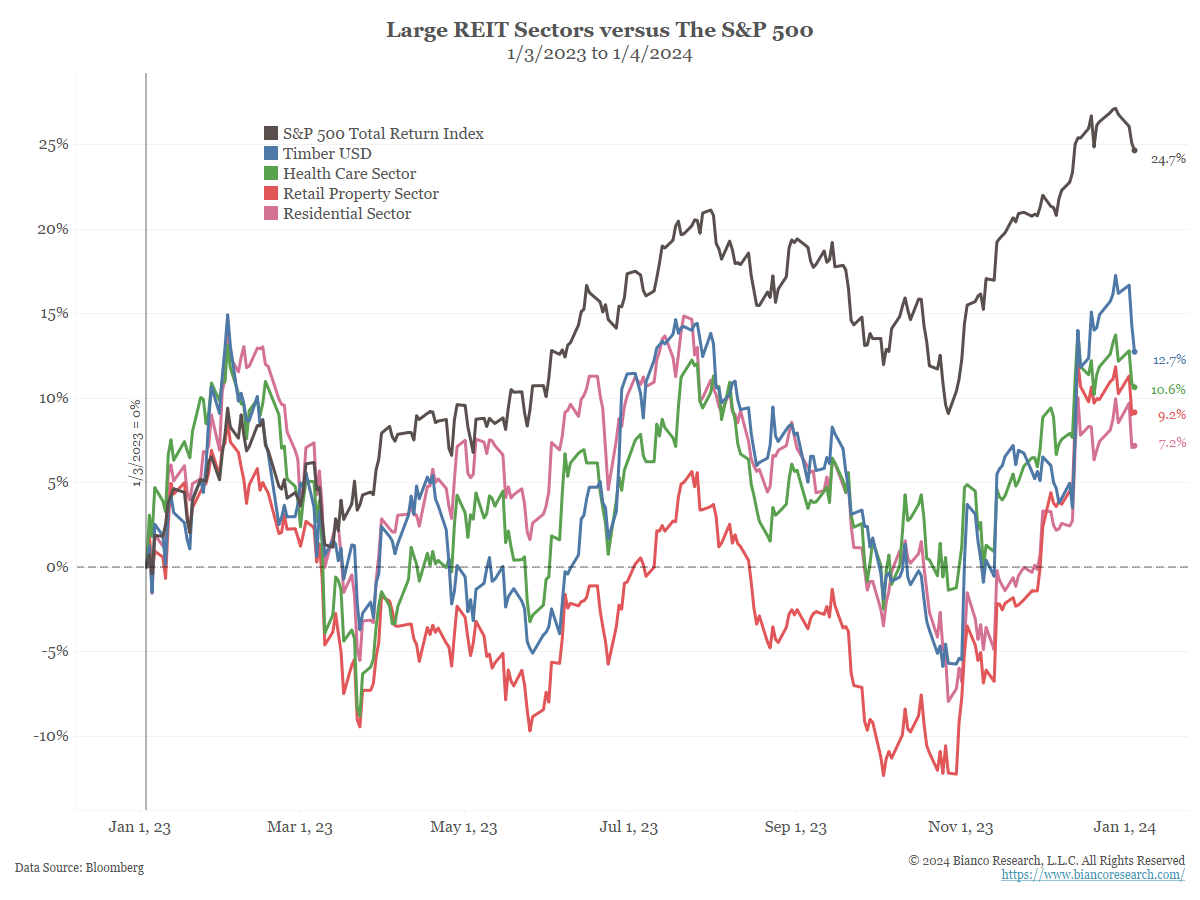

Other Big Sectors

Finally, some other significant sectors are shown below. Note that they all underperformed the S&P 500. This includes:

- Timber at 12.7% (blue)

- Health Care at 10.6% (green)

- Retail at 9.2% (red)

Residential at 7.2% (pink)

Add it up, and the REIT sector, as a proxy, did not have a good year. Only a few outperformed the S&P 500. Rising mortgage rates were the main culprit.

Note that in most of the charts above, the REITs had a big run higher in November and December as mortgage rates fell. This underscores how these instruments are largely interest proxies and need lower mortgage rates to compete with the broader stock market.

Conclusion

Conclusion

The biggest laggards that we were way behind the S&P 500, were: