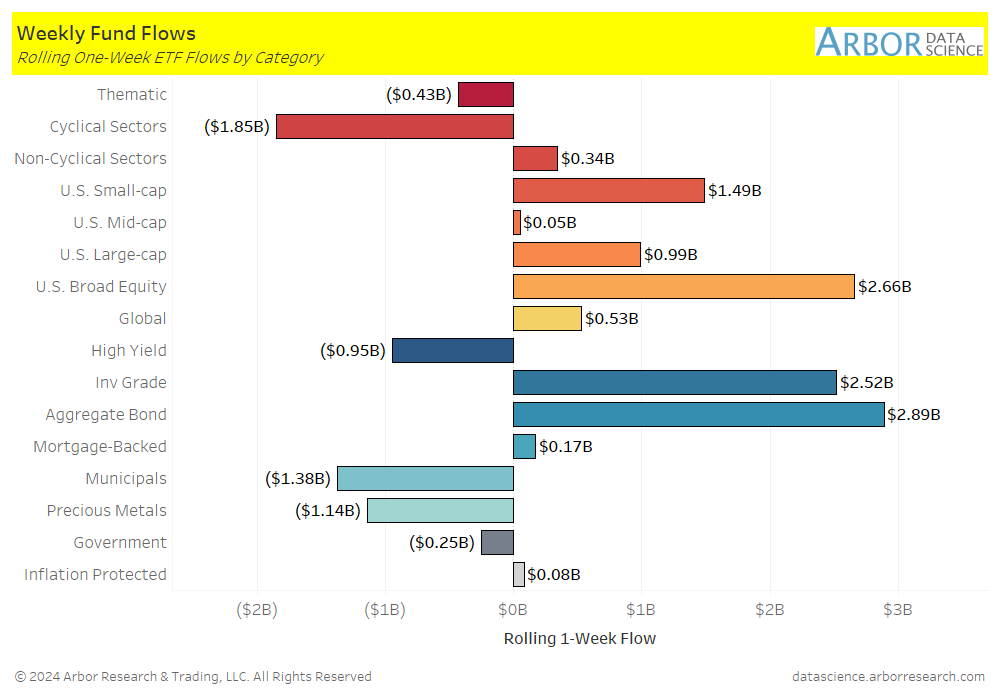

- On a weekly basis, U.S. Large-cap ETFs saw a eighteenth consecutive week of inflows at approximately $0.99 billion compared to the prior week, which saw $10.79 billion added.

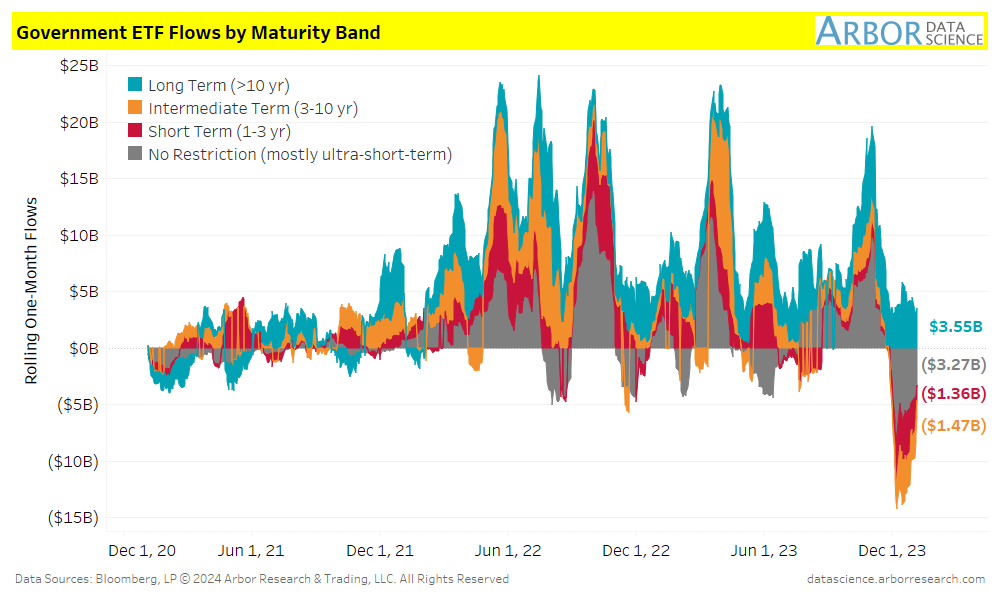

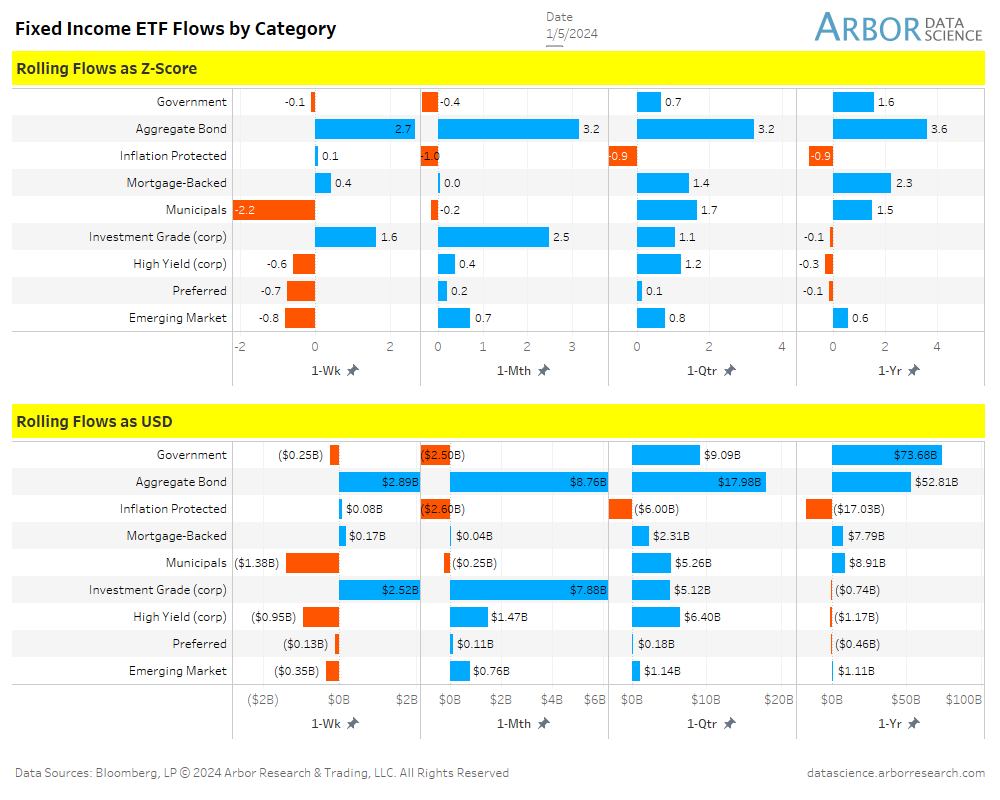

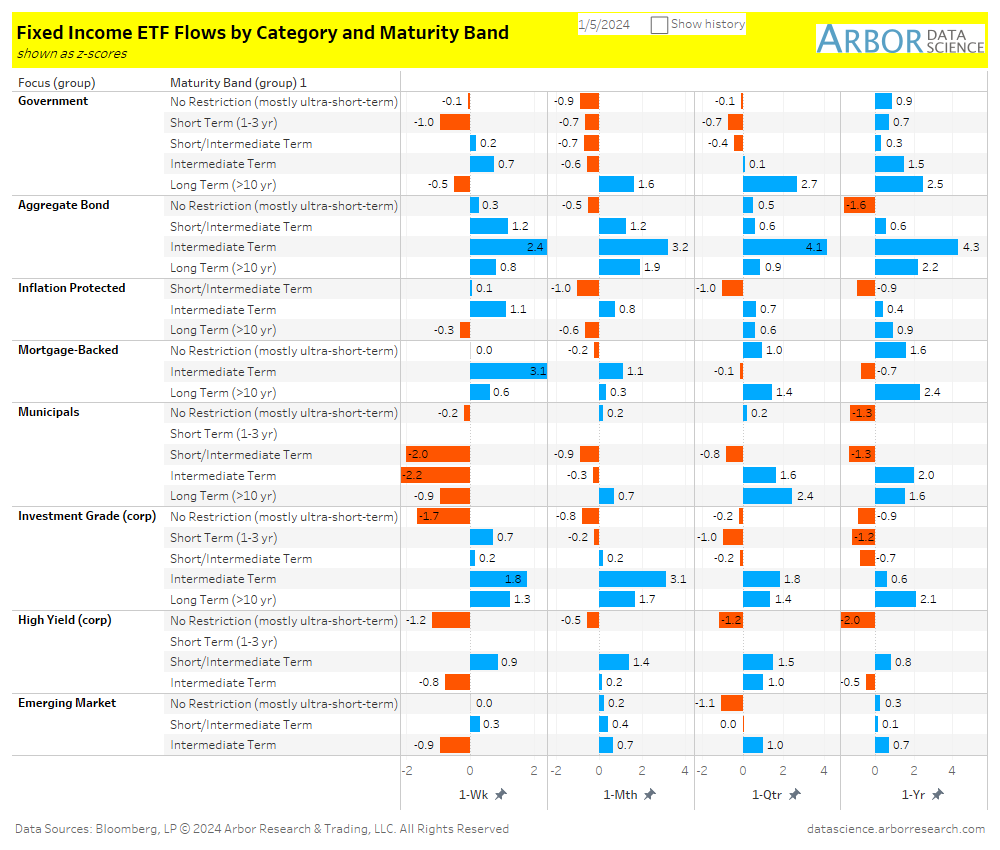

- On a weekly basis, Government bond ETFs had outflows of approximately $0.25 billion, compared to outflows of $1.37 billion the prior week.

- The top two movers of the week were U.S. Broad Equity with inflows of $2.66 billion from a outflow of $6.44 billion last week. Aggregate Bonds had an inflow of $2.89 billion from an inflow of $2.82 billion, last week respectively.

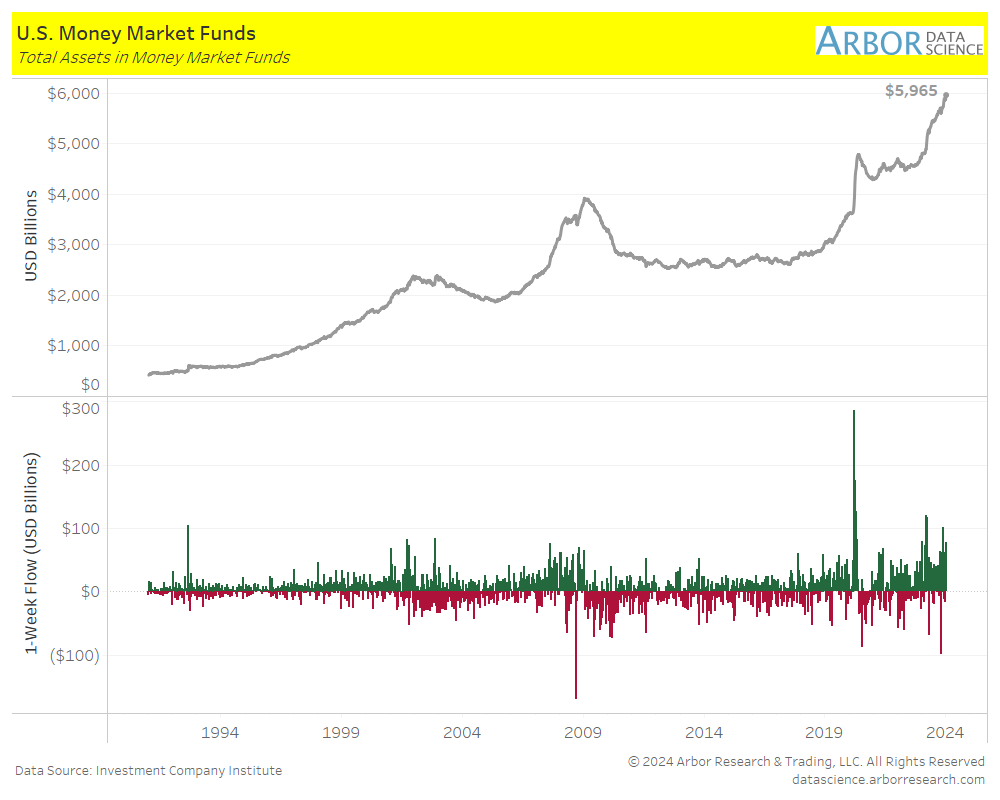

- The amount invested in Money-Market Mutual Funds (MMMFs) increased to $5.965 trillion in total assets, compared to $5.870 trillion reported the prior week.

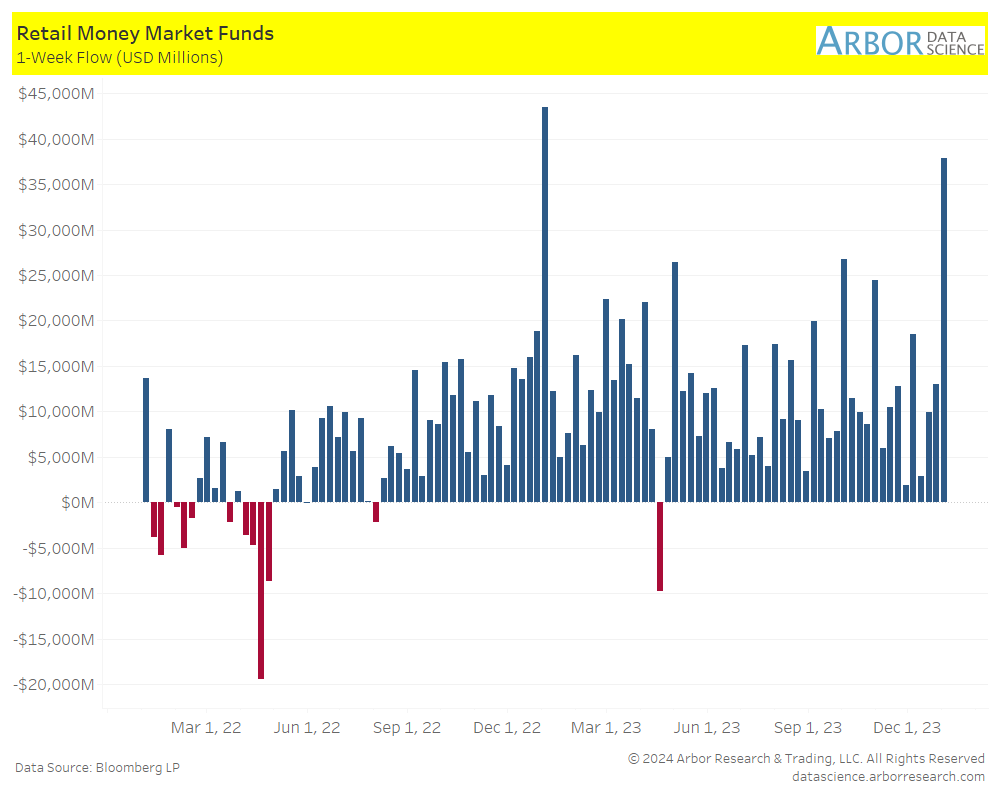

- Retail money market funds had their largest inflow for the date range (1/1/22-1/3/24) since the first week of 2023.

- Long-term (> 10 years) Government ETFs had $3.55 billion invested over the last month, while the rest had outflows, with the largest being $3.27 billion in mostly ultra-short-term ETFs.

-

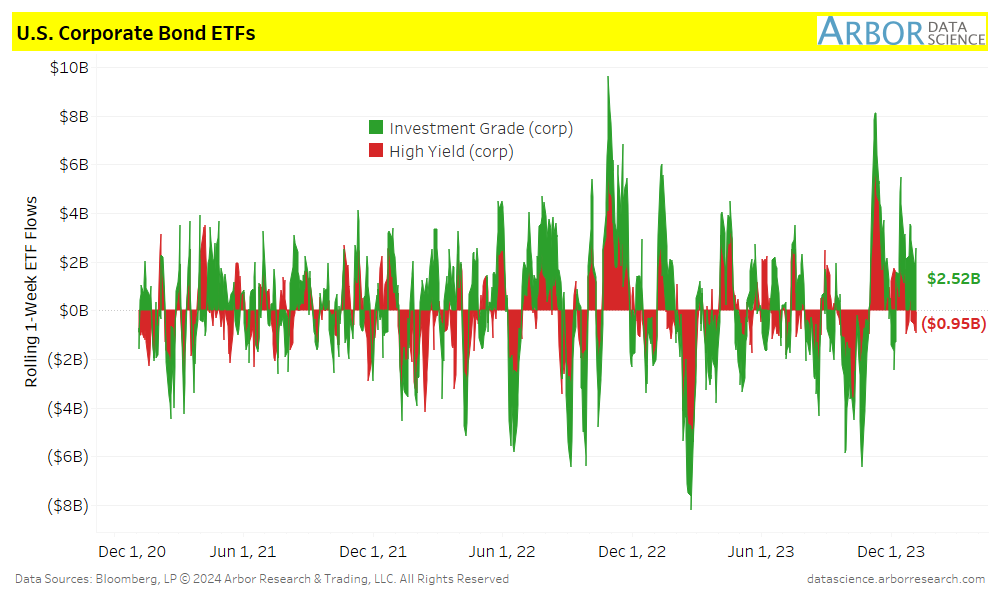

Corporate bond ETFs were mixed last week, with investment-grade ETFs gaining $2.52 billion and high-yield ETFs losing $0.95 billion.

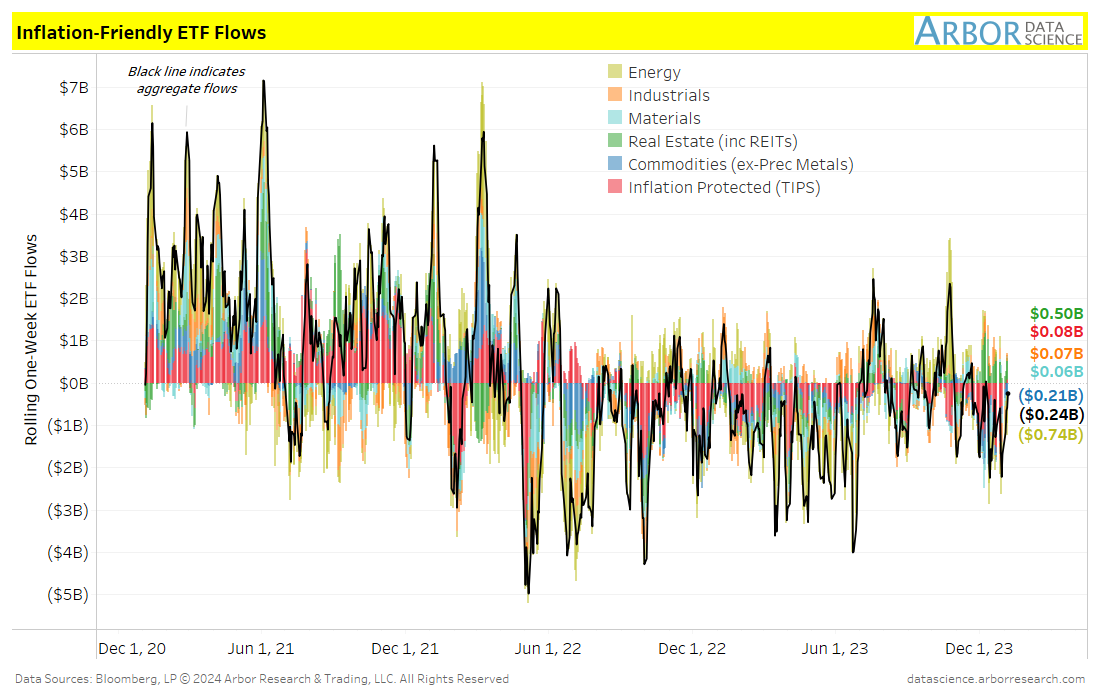

- Aggregate flows were negative for the week, with $0.24 billion of outflows. The largest driver of outflows was $0.74 billion in Energy.

- Real Estate and Inflation Protected (TIPS) saw the largest inflows for the week at $0.50 billion and $0.08 billion, respectively.