The basic straight trend-line still projects RRP volume to hit zero at the end of March. Once that occurs, BSR and Treasury issuance will be eating into the liquidity in the financial system pic.twitter.com/iOqAZaQuAL

— Scott Skyrm (@ScottSkyrm) January 10, 2024

Summary

With the Fed’s Reverse Repo Facility balance continuing its linear decline, the recent liquidity pump is nearing its end. How will this impact bank reserves and the Fed’s ongoing Quantitative Tightening (QT) campaign?

Comment

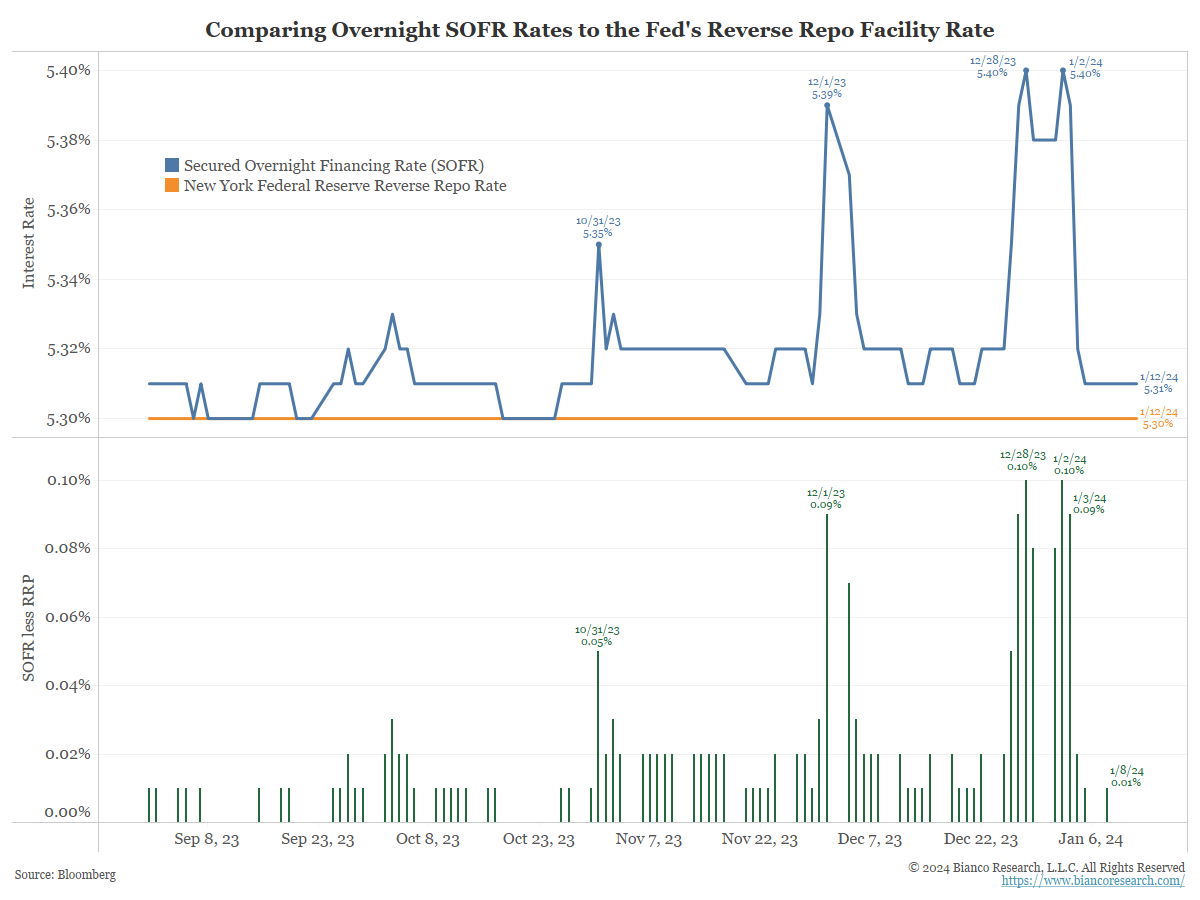

One way to view liquidity is the ability to get a collateralized loan for cash at market rates. The Secured Overnight Financing Rate (SOFR), shown in blue below, is one of the more popular market rates for such a loan.

These loans are the lifeblood of the financial system. They are used to settle transactions or post margin on futures, options, derivatives, or swap transactions.

Instead of being forced to sell securities to settle these transactions or margins, securities on one’s book can be posted as collateral for a loan. Typically, they are one-day (or overnight) loans that can be rolled every day for as long as needed.

What should be the market rate on these loans? Ideally, they should be within one or two basis points from the New York Fed’s Reverse Repo rate (RRP), shown in orange. This rate is derived from the Fed’s target range for fed funds (20 basis points below the top end, which is currently 5.25% to 5.50%, putting the RRP at 5.30%).

The spread between SOFR and the Fed’s RRP rate is shown in the bottom panel.

If liquidity is a problem, meaning cash is in great demand, SOFR rates will trade at a more significant premium to RRP (green).

Liquidity gets tight around the end of the year and slightly tight around the last day of a month. This can be seen in the various month-end spikes in the spread above. These moves are expected as the supply of cash to extend these loans is tight these days due to bank and dealer monthly and quarterly reporting requirements.

But if the spread above starts to widen and holds, it signals liquidity is an issue. The demand for collateralized loans is outstripping the available supply of cash to provide them.

Standing Repo Facility

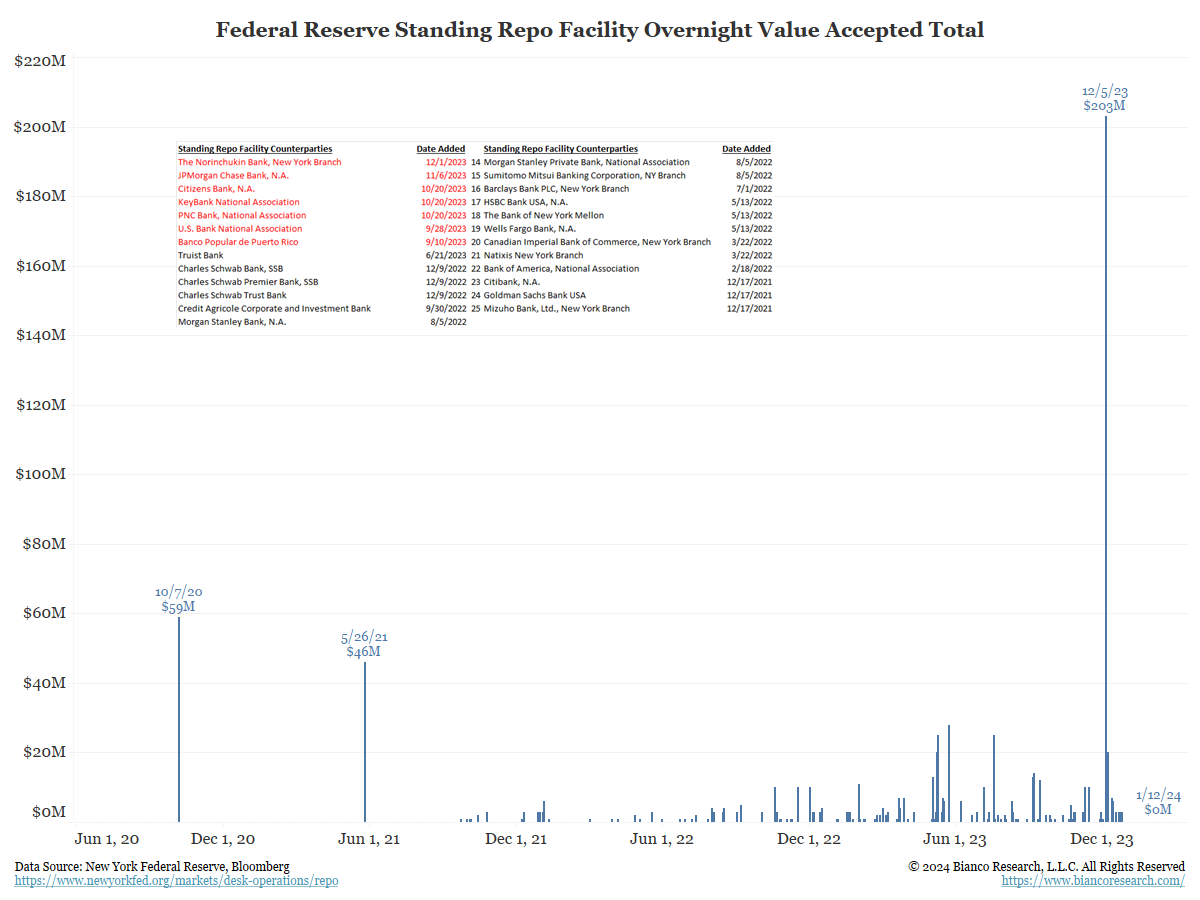

The Fed is very concerned when SOFR starts to show a premium to the RRP rate. So, they invented a facility to use their printing press to offer an unlimited supply of these loans effectively. It is called the Standing Repo Facility, or SRF.

SRF loans are offered to dealers, so they have a nearly unlimited supply of cash to deploy to financial market participants.

The Fed offers SRF loans at 20 basis points above the RRP (now 5.30%) rate, meaning the current SRF rate is 5.50%.

These loans are crucial to the financial system’s plumbing, and when getting them requires a significant premium above market rates, financial market chaos typically follows.

This is why the SOFR/RRP spread gets so much attention. It is a signal of stress in the funding markets. So when it widens to ten basis points, halfway to the Fed ceiling of 20 basis points above RRP, it gets noticed, and concerns begin to rise.

The following chart shows that the SRF is not currently getting used. No dealer wants to take out a loan with the Fed at 5.50% when market-based rates are lower.

The recent one-day spikes above in its usage are believed to be dealers testing the system and not a signal of liquidity stress.

Also, note the table and the names in red. This facility existed as a temporary program until 2021, then it became permanent. At that point, the dealers had to sign up again for the “new” permanent version even though they were already signed up for the “old” temporary version.

The red names are the dealers that have signed up in the last few months. A third of them signed up since September after being slow to join over the previous two years.

This has raised eyebrows as many wonder if the dealers anticipate liquidity problems and prepare for this day.

RRP – The End of the Liquidity Pump

The SRF is not very well known. But its opposite facility, the RRP, is well known. This is because it had trillions of dollars in it. What is the difference?

- The SRF is used when there is a shortage of cash. The Fed then offers cash to keep rates from spiking.

- The RRP is used when there is an abundance of cash. This is a way to park excess cash at the Fed to prevent funding rates from plummeting below the Fed’s target rate.

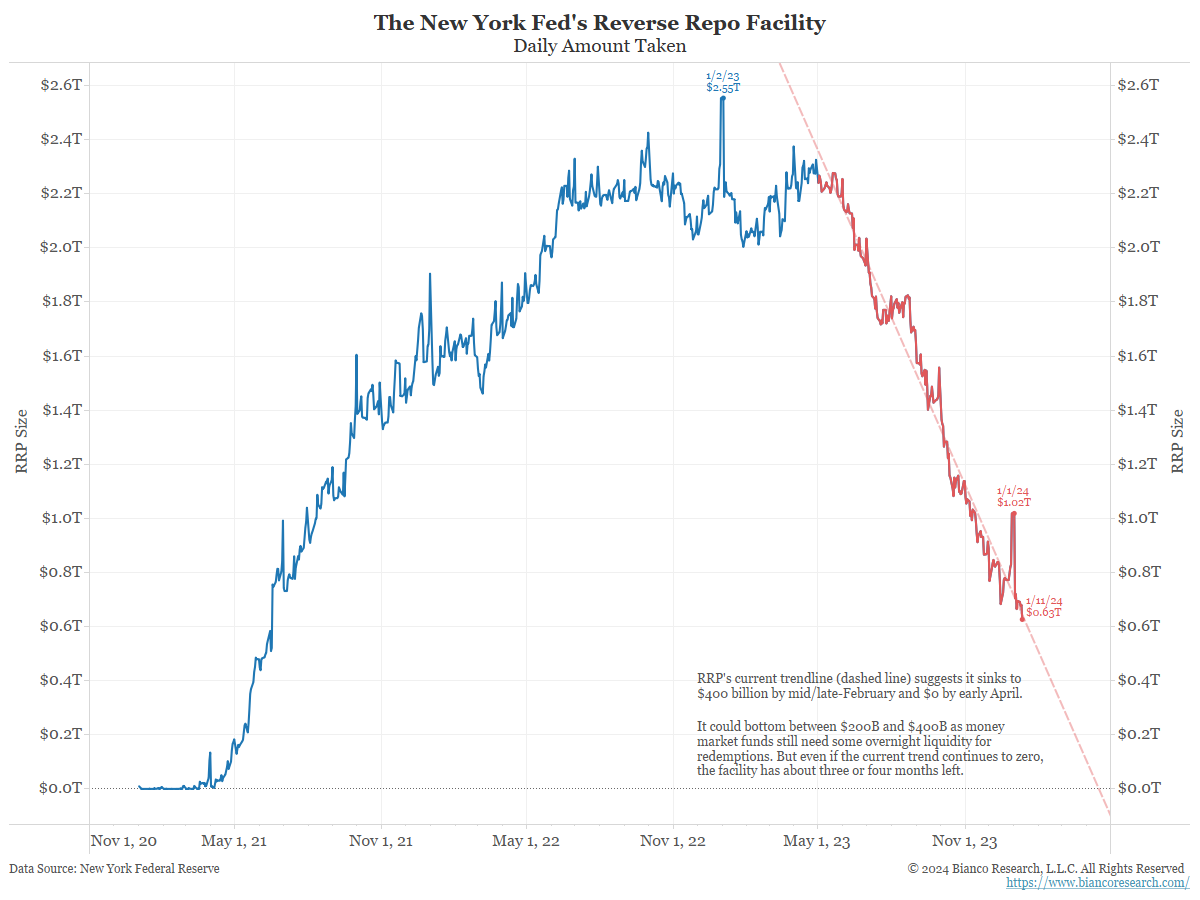

When money is parked in the RRP at the New York Fed, it is effectively removed from the financial system, reducing the supply of available funds. This is what happens when RRP rises in blue below.

Conversely, when the RRP falls (red), money is moved from outside the financial system (at the New York Fed) back into it.

Falling RRP is effectively a “liquidity pump” for the financial system.

There is a lot of discussion around the speed and trajectory of the amount in the Feds facility (the dotted red line above.)

The facility will be “drained” in about two months if it holds this trajectory. Then, the market will be left without a liquidity pump that has been offsetting the liquidity drain from quantitative tightening (QT), which drains $95 billion/month of liquidity out of the financial system.

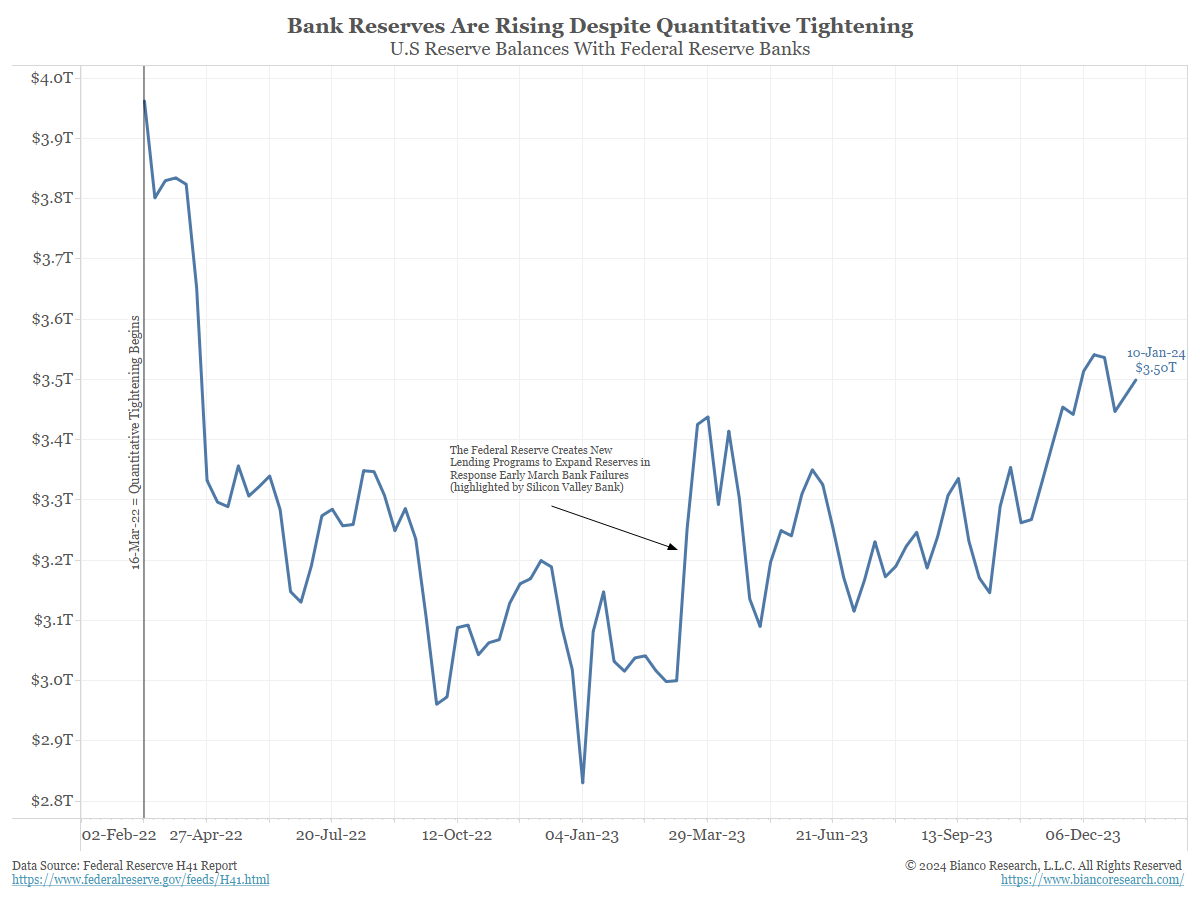

The following chart shows total bank reserves have been increasing over the last 18 months. RRP has been falling (liquidity reentering the financial system) faster than the Fed has been draining liquidity via QT.

- Bloomberg (January 6, 2024) Logan Says Fed Should Slow Asset Runoff as Reverse Repo Dwindles

Fed shouldn’t rule out chance of another rate hike, Logan says

Dallas chief warns easing financial conditions may fuel demand“In my view, we should slow the pace of runoff as ON [overnight] RRP balances approach a low level,” Logan said, referencing the Fed’s overnight reverse repurchase facility, a place where counterparties such as money-market mutual funds can park excess cash. “Normalizing the balance sheet more slowly can actually help get to a more efficient balance sheet in the long run by smoothing redistribution and reducing the likelihood that we’d have to stop prematurely,” she added.

She is worried that when the RRP liquidity pump ends, the financial system’s plumbing may have trouble securing collateralized loans, and trouble will follow.

What Should the Fed Do?

The Fed has two main policy levers – rate cuts/hikes and QT/QE.

If they are about to embark on a significant change in their use of rate cuts, would they also want to change a second variable at the same time? In other words, if they start cutting rates at the same time they stop QT, how will they know which part of their policy is or isn’t working and to what degree?

The current consensus, via surveys from the primary dealers, is that QT ends in Q4 when the Fed’s balance sheet hits the neighborhood of $6.75T (the balance sheet was at $7.3T when that survey was taken, and it stands at $7.07T now).

Since they are shedding $95B a month off the balance sheet, that would imply dealers see a slowdown in QT’s pace at some point before it comes to an end in Q4. Lorie Logan agrees.

Given the confusion a two-pronged change could cause, we believe the Fed is unlikely to tweak both of these levers at the same time.

If markets react badly, how do you know the reason? Do rates need to fall faster or does QT need to end faster? It is better to turn one dial at a time to better gauge its impact.

With the Fed projecting three rate cuts in 2024, they are committed to turning the interest rate dial lower. So, they do not want to turn the QT dial unless necessary.

Conclusion

We expect the Fed will watch liquidity metrics closely, but will not end QT until the balance sheet gets well under $7 trillion or they have a few cuts under their belt.

If the SOFR/RRP spread starts to widen, the Fed might change and consider turning the QT dial to end it faster. But, again, this spread is not widening beyond normal month-end and year-end.

So what happens when RRP effectively hits zero? The fear is liquidity becomes an issue, SOFR spikes above the RRP rate, and the Fed’s SRF starts getting used.

Lorie Logan is the President of the Dallas Federal Reserve. Before this job, she headed the New York Open Market Desk during the repo crisis of September 2019.

So, when she speaks about liquidity, her words get a lot of attention.