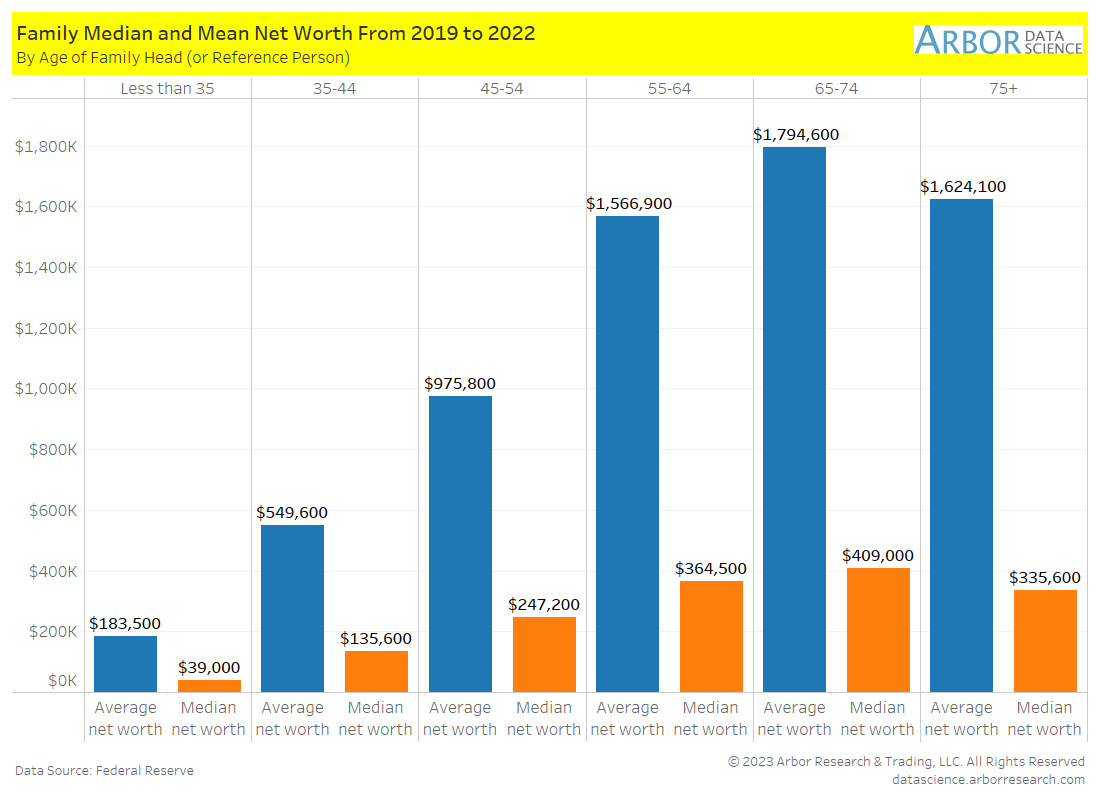

- In October 2023, the Federal Reserve released a report of changes in family finances for the time period 2019 to 2022. The chart below shows the average family net worth (blue) and the median family net worth (orange) from 2019 to 2022. The average net worth peaked at $1,794,600 for the ages of 65–74. As the median net worth peaked in the same age range of 65-74 at $409,000.

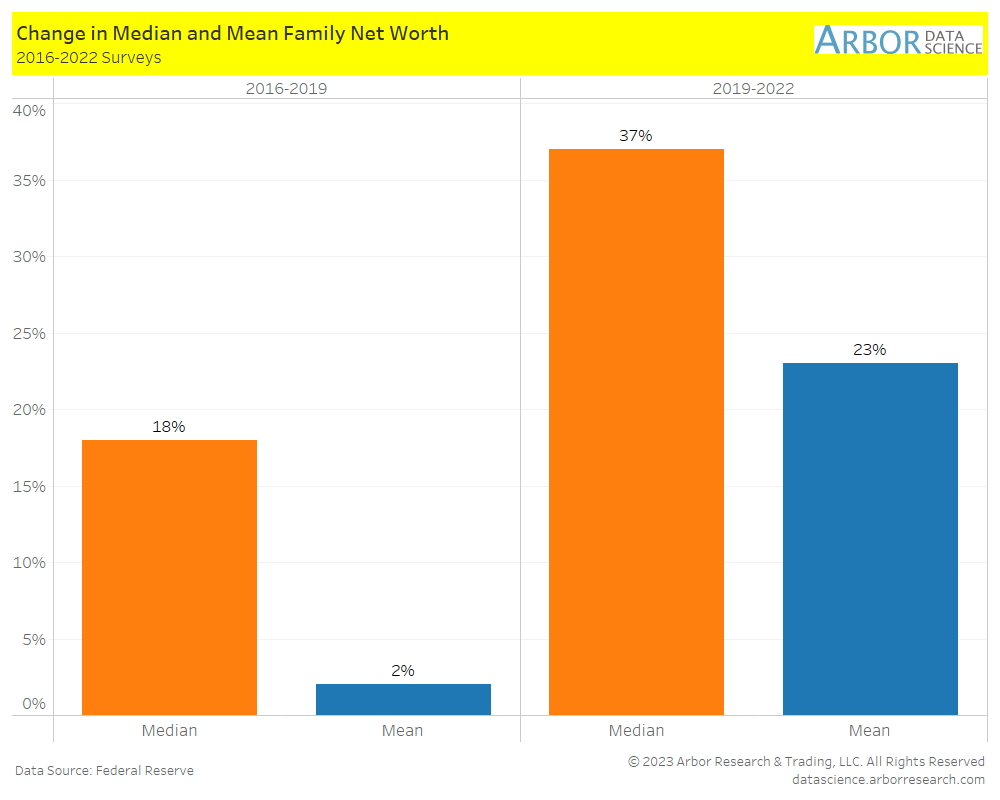

- The chart below shows the change in median and average family net worth for a six year period. 2019-2022 had the largest change for median and average family net worth at 37% and 23%, respectively.

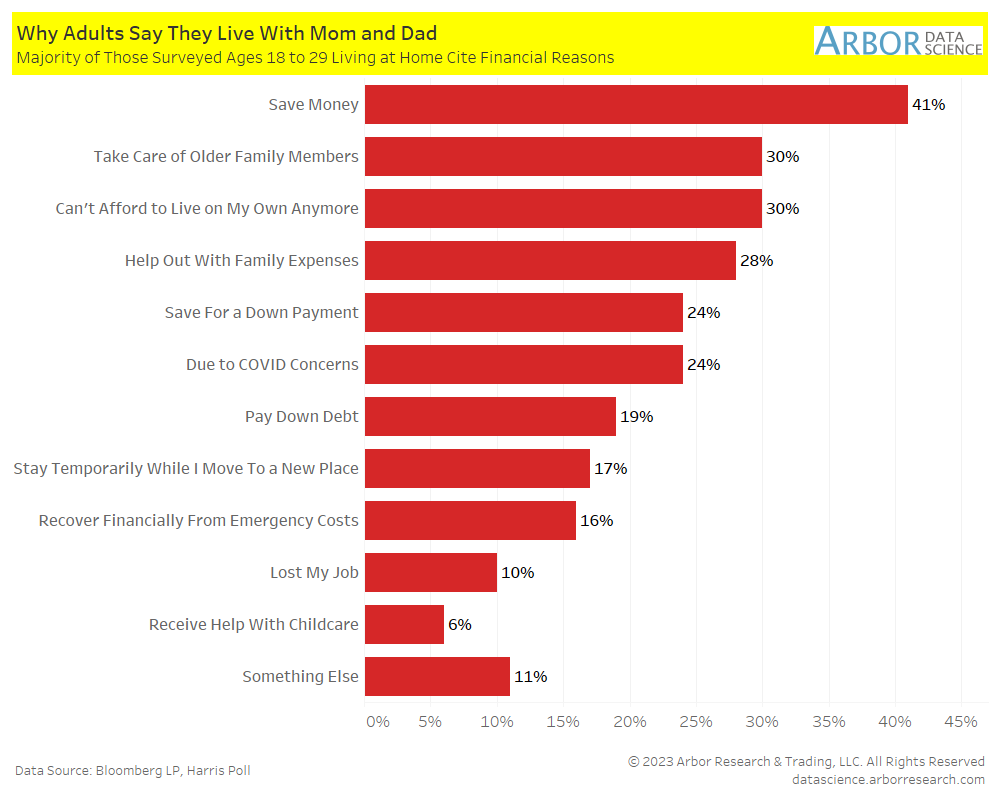

What are the reasons young adults are staying at home longer with mom and dad?

- The chart below surveyed young adults between the ages of 18-29. They mention financial stress as the reason why they live with their parents. 41% of young adults living at home mention saving money and 30% mention that they no longer can afford to live on their own.

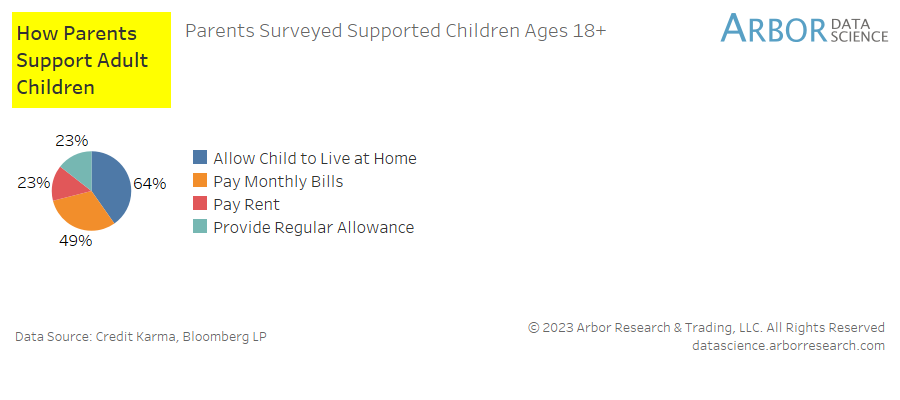

- The pie chart below depicts the results of a survey conducted by Credit Karma, which surveyed parents who supported children of the ages 18 and older. The survey showed that 64% of the parents surveyed let their 18 year old’s live at home. 49% of parents pay their children’s monthly bills!

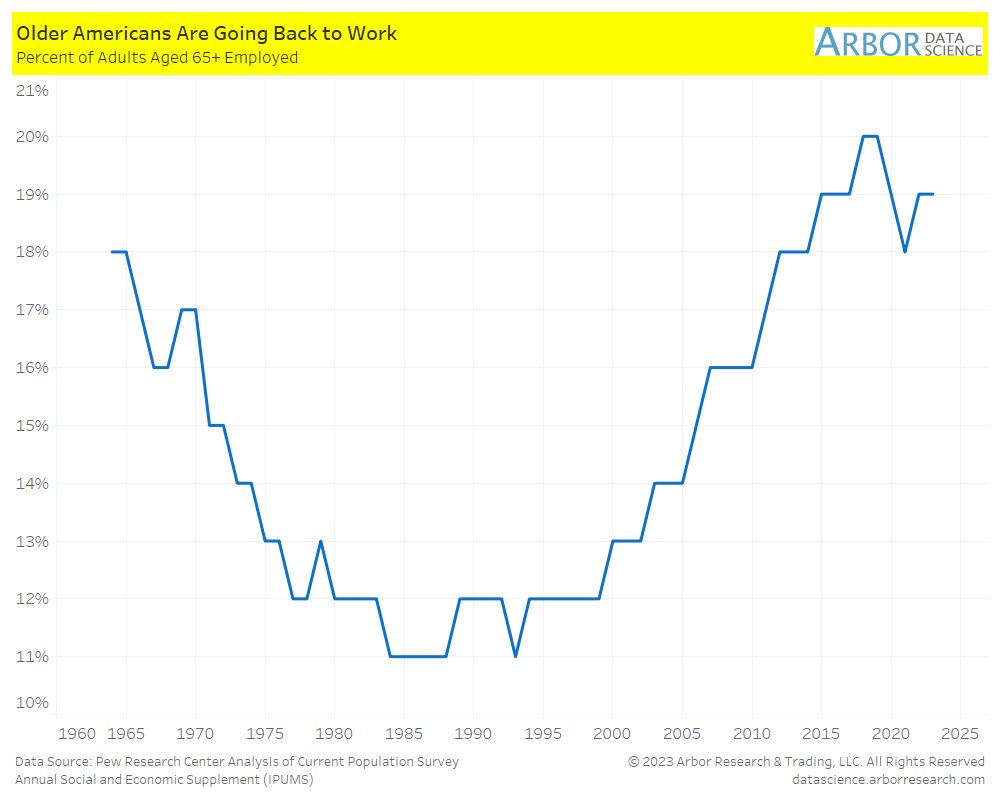

Since around the start of the 1990s, an increasing percentage of older Americans (65+) are going back to work. In 2023, 19% of American adults participated in the workforce. This percentage peaked in 2018 and 2019 at 20%.

Why are adult children having to move back in with their parents?

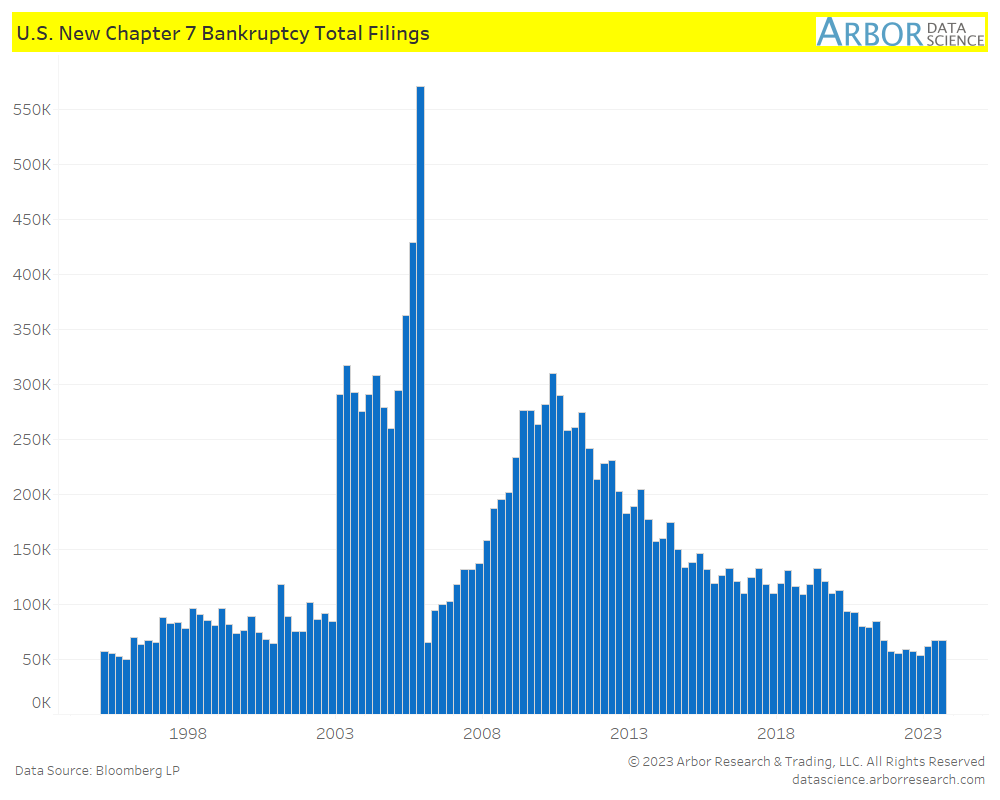

- According to Fox News, more student loan borrowers are filing for bankruptcy in order to offload their debt after a three-year hiatus. Chapter 7 Bankruptcy filings peaked on 12/31/2005 at 570,355. On 9/30/2023, 66,938 total filings were filed.