- Bloomberg – The Fed Will Set the Pace for Markets More Than Ever This Year

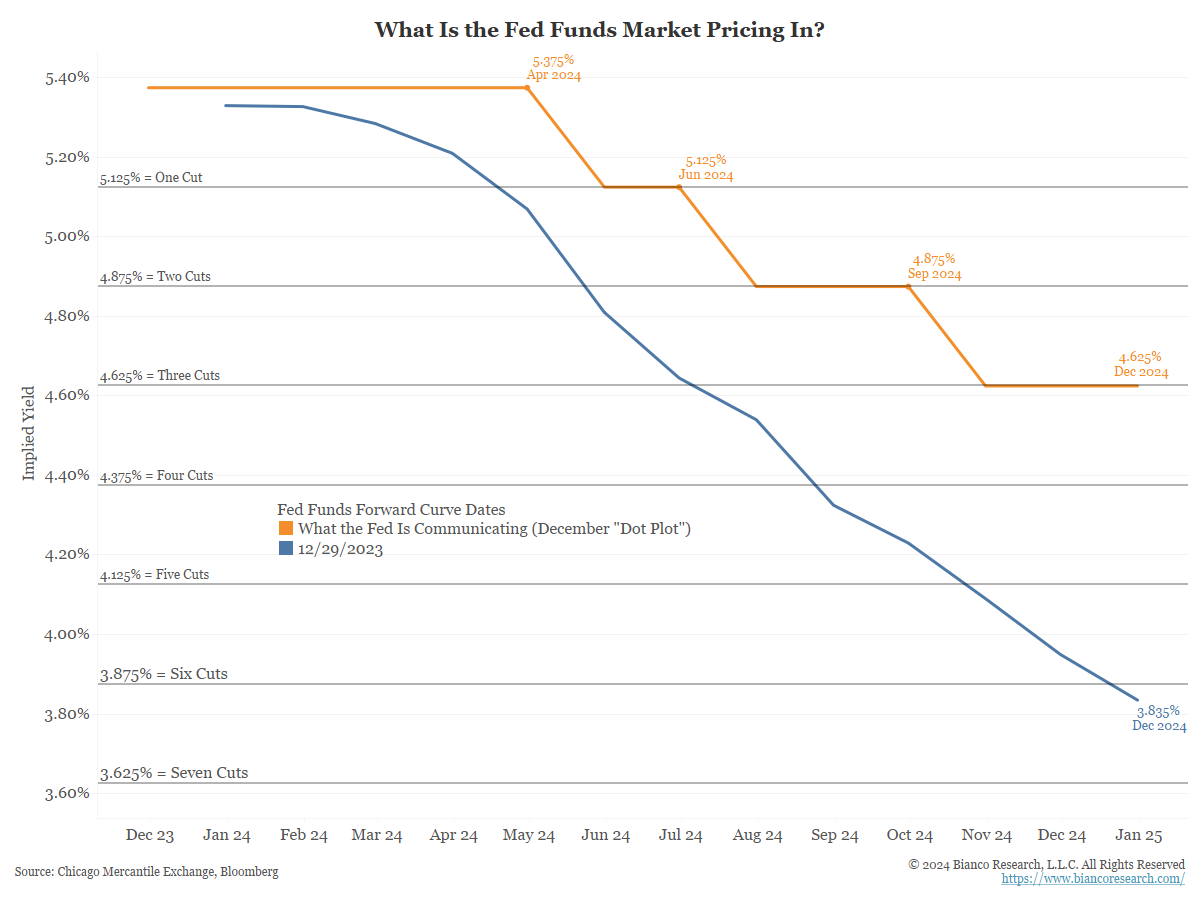

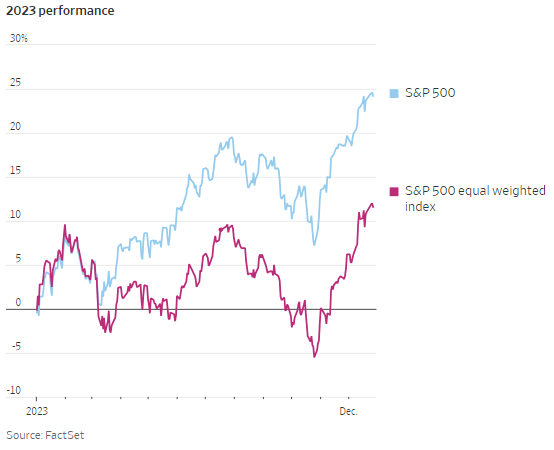

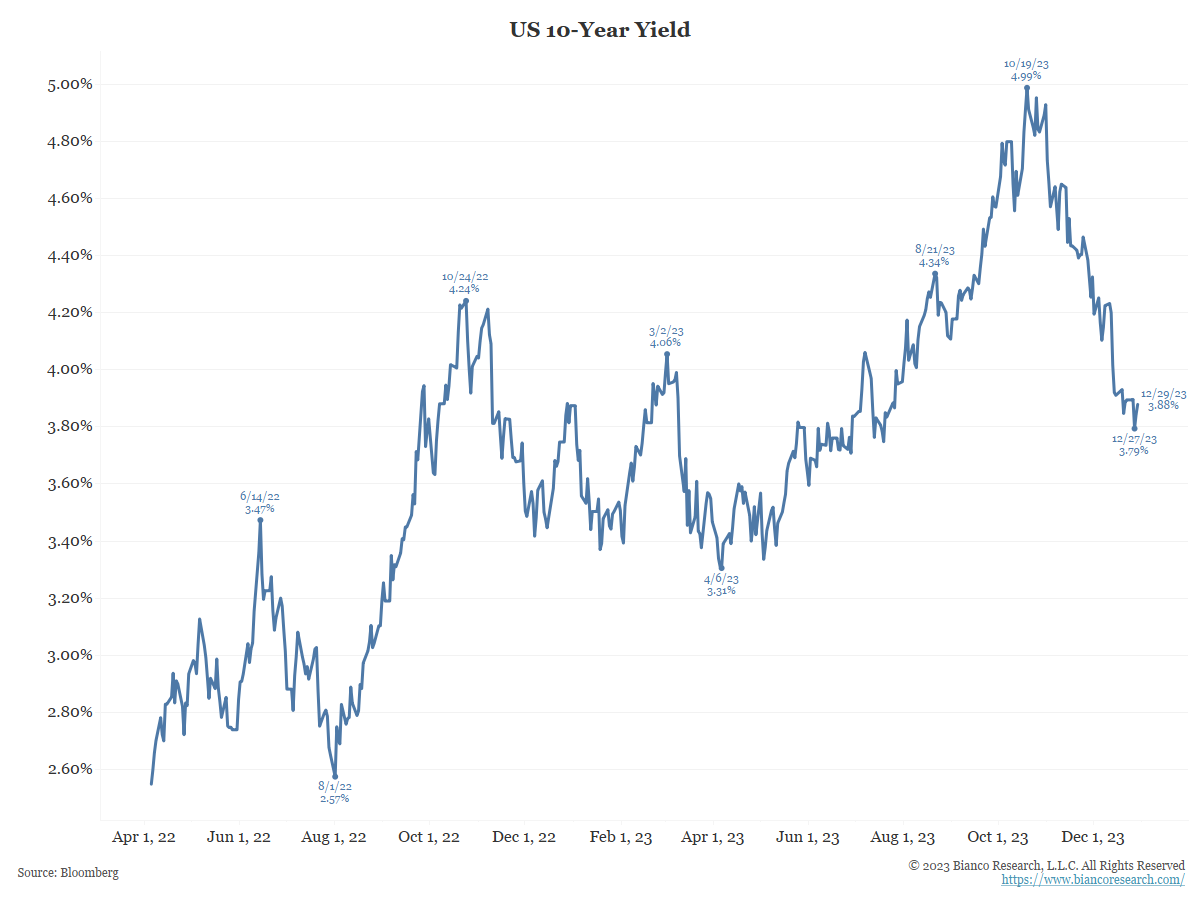

The prospective easing cycle is likely to be both quicker and shorter than the last two years of ever-higher borrowing costs. Futures markets badly underestimated the US central bank’s resolve to curb consumer price increases in 2023. Garnering a clearer picture of where official interest rates level out is the big trade for fixed-income markets this year, and will determine the shape of the (currently still inverted) yield curve. In the meantime, most of the world’s central banks are locked in the Fed’s tractor beam — where it leads, others will have to follow.

Are Supply Chain Problems Returning?

- The Wall Street Journal – New Disruptions, Geopolitics Hang Over 2024 Supply Chains

Companies looking to establish resilience in the wake of the pandemic already are putting rebuilt sourcing and logistics strategies to work

Global supply chains are entering 2024 roiled by disruptions at two of the world’s crucial trade corridors—the Panama Canal and the Suez Canal—even as geopolitical tensions appear set to take a more prominent role in sourcing and distribution. That could potentially force countries and companies to redraw trade maps that have been built over decades.

Comment

Discovering the ‘New Normal’

- Bloomberg – 2024 Will Mark the End of the Post-Pandemic Economy

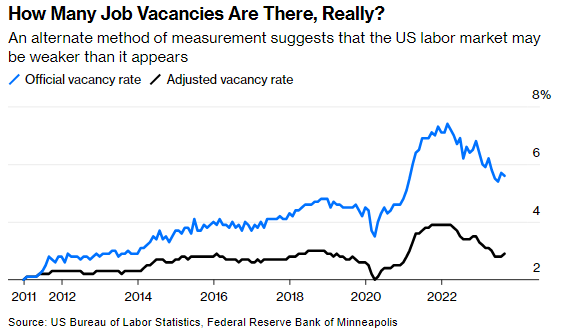

The post-pandemic economy was marked by several unlikely factors. Shortages coming out of the pandemic sparked inflation, which was then exacerbated by unnecessarily expansionary monetary and fiscal policy. Just as the economy was poised to recover, in other words, policymakers gave it rocket fuel. All that stimulus money increased household savings. Savings-rich households kept spending, and firms desperate for workers faced an exceptionally tight labor market. Meanwhile the Fed not only pursued nominal zero rates, it tried to bring down longer term rates and mortgages — and did so well after the pandemic had ended. The result was that even as rates increased, the economy stayed somewhat resilient. During the long period of low interest rates that preceded the post-pandemic, many firms, investors and households locked in low rates. Thus they were relatively unaffected by rising rates.

- Reuters – For investors, 2024 is the year of transition to a new economic order

While the Fed and other banks have been raising rates for well over a year, the world is yet to complete the transition from the time when money was free to a period when it no longer is. 2024 is likely to be the year when the effects of that transition manifest more clearly. That means companies – and in some cases, entire countries — will have to restructure their debt liabilities, as they can no longer afford to pay interest. Some of that is already visible in emerging market debt negotiations and rising bankruptcies of companies. U.S. corporate bankruptcy filings hit the highest since 2020. More are likely on the horizon.

- Wall Street Journal – Investors’ Hope for 2024: A Return to Long-Lost Normalcy

That means bonds promise solid returns if interest-rate expectations don’t change. They also have more room to rally if economic conditions deteriorate and the Fed cuts rates more aggressively. Rising rates have been painful recently. But the previous period of near-zero rates was also “not a stable equilibrium,” given how those rates punished certain savers and rewarded businesses that would have otherwise been uncompetitive, said Matt Toms, global chief investment officer at Voya Investment Management. “We’ve returned to a point that looks a heck of a lot more stable,” he added. Markets have taken a long road to get here.

- Bloomberg – The New Economic Normal Isn’t Anything We’ll Recognize

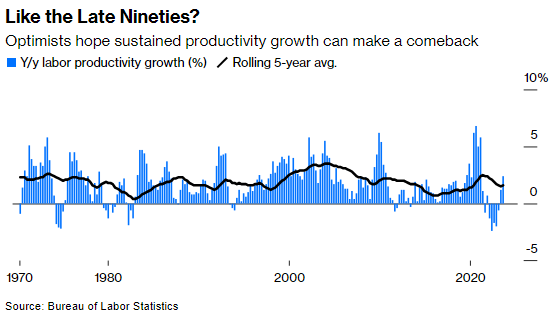

Another (more optimistic) take on the “new economic normal” is that it looks something like the late 1990s. That was a time of resurgent growth driven by increasing labor productivity. In the popular imagination, a 2020s productivity boom would look something like the one that accompanied the emergence of the internet, except with the proliferation of artificial intelligence instead of email and e-commerce. That’s an appealing vision. If AI meets these lofty expectations, it’s easy to imagine how it could increase the output of paralegals, coders and any number of other knowledge workers, at least on a per-hour-worked basis (the jury is still out on how many of us will remain gainfully employed.)

Office Real Estate

- Financial Times – US office owners face $117bn wall of debt repayments

“It’s going to be a problem to get some of these refinancings done,” said John Duncan, who heads the real estate finance practice at law firm Polsinelli. “We’re seeing deals where even sophisticated borrowers are calling it a day and asking their lenders whether they would like to take the keys.” Unlike US home loans, commercial mortgages are almost entirely interest- only. That means developers of large properties tend to have low monthly payments, but face a balloon payment equal to the original loan the day the mortgage comes due.

Comment

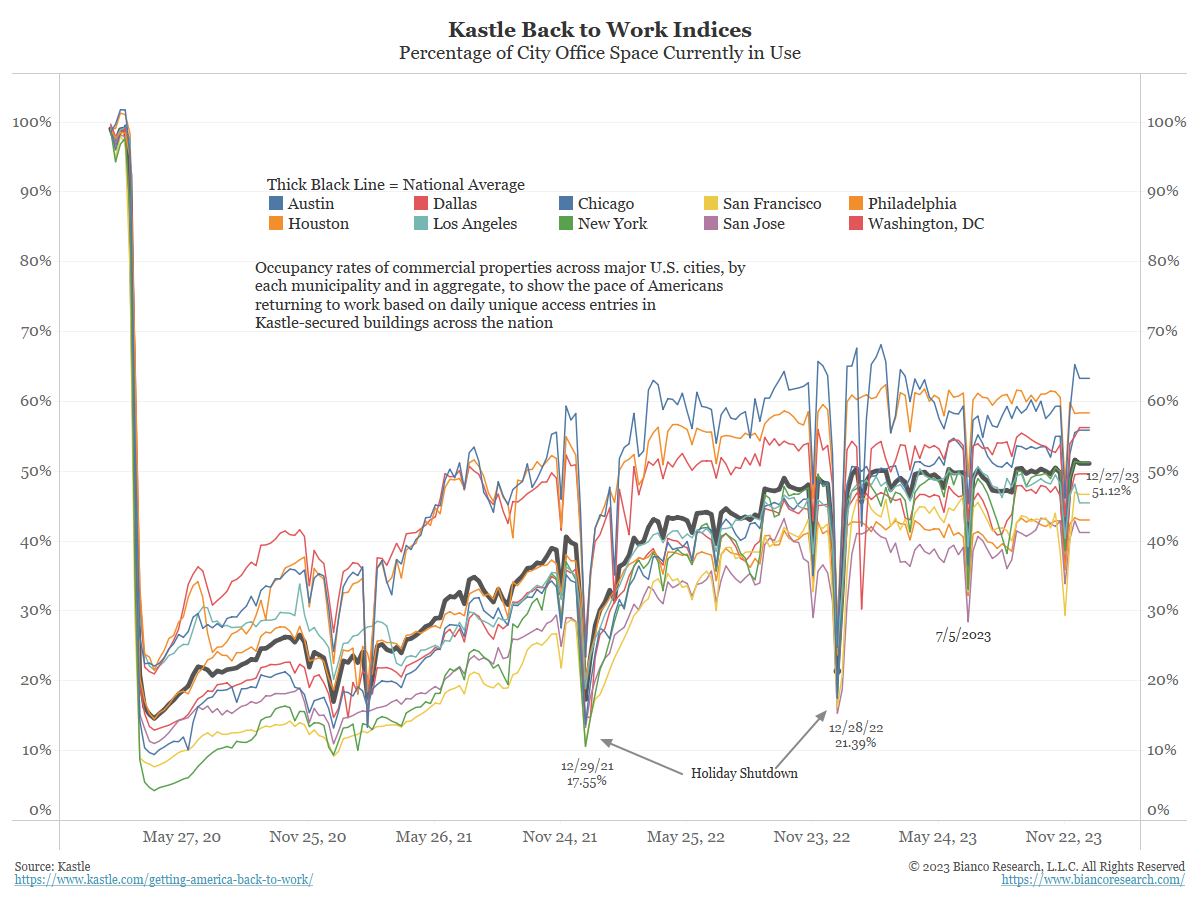

According to Kastle Data, the average percentage of city office space in use is only 51%. Manhattan usage is equal to the national average.

Predicting Disruptions in 2024

- Wall Street Journal – New Disruptions, Geopolitics Hang Over 2024 Supply Chains

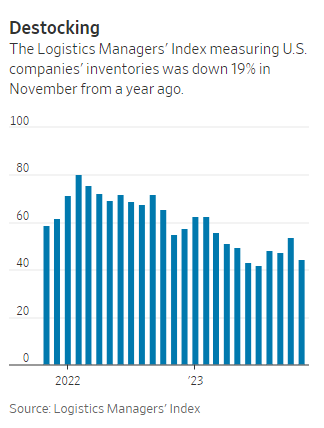

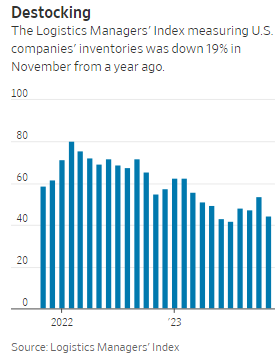

All of this is buffeting supply chains from semiconductors to consumer goods, pressing companies that sought to bring greater resilience and flexibility into their operations to act in a fast-changing manufacturing and shipping environment. The sudden shocks and shifts will pose a challenge this year to ocean carriers, truckers and other freight and logistics companies that will have to divert resources according to diversions in cargo flows and swings in demand. Wars in Ukraine and in the Middle East are threatening flows of grain, oil and consumer goods. Climate change and mass migration are disrupting trade lanes from the Panama Canal to the U.S.-Mexico border. Growing geopolitical tensions are making international supply chains ever more complex. Still, many companies, including big retailers, can point to dramatic success over the past year in clearing out the big stockpiles of inventory that they built up during the pandemic to cope with shipping disruptions and rapidly changing consumer buying patterns.

Still Work To Do on Inflation

- Bloomberg – The People’s Inflation Is Still a Big Problem

The situation with shelter is even worse. The US housing market has struggled to fully recover since single-family home construction collapsed two decades ago, amid the bursting of the subprime mortgage bubble. No part of the market, except perhaps the very top, has been spared. Over the past three years, mortgage rates have more than doubled. Average rents, as measured by the Consumer Price Index, have increased 21%. One in four homeowners are “house poor,” and the median renter is “rent-burdened,” spending more than 30% of income on housing. Homelessness is soaring as home affordability plunges to record lows. If the difficulty in affording food and shelter were a shared experience, it might incite less dissatisfaction. It’s not.

Comment

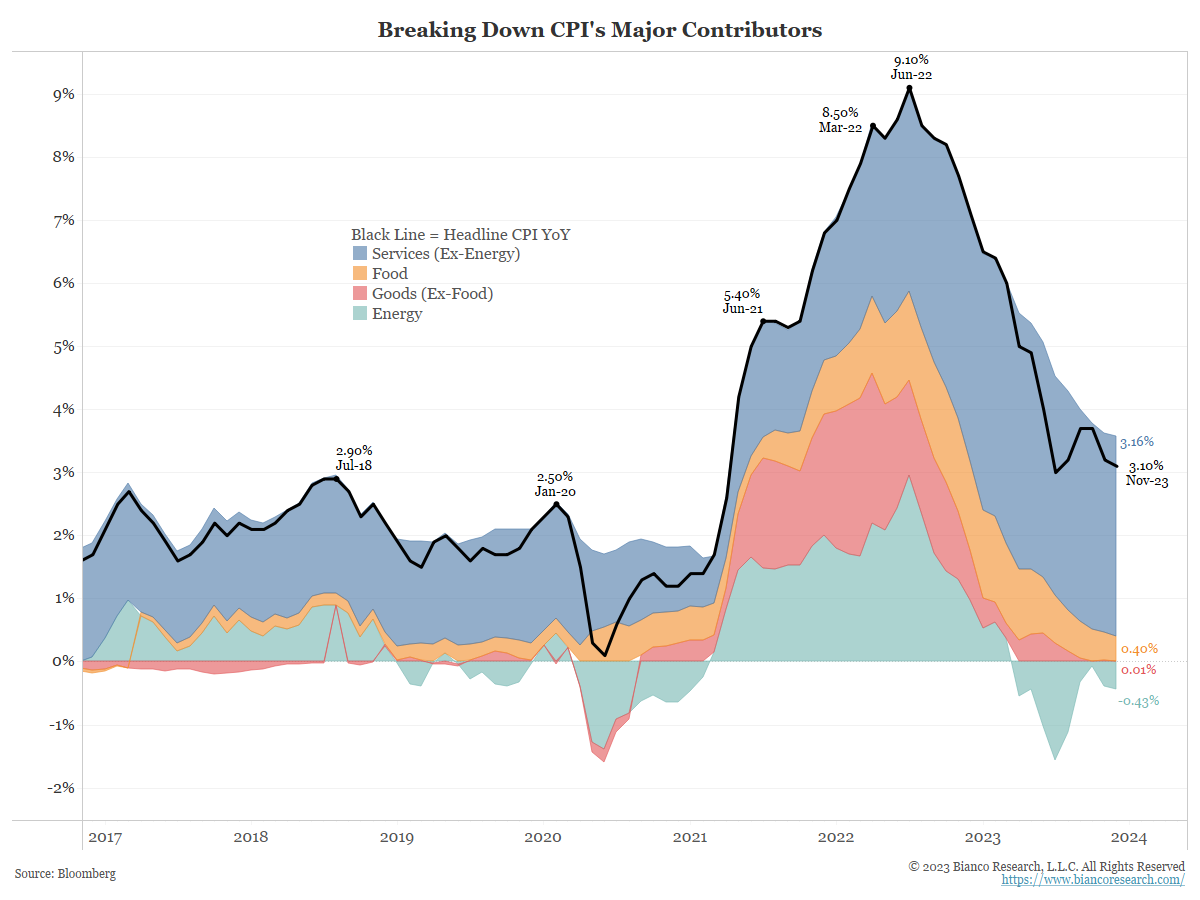

Inflation peaked in June of 2022 at 9.1%, the highest level in decades. Since then, inflation, measured on a headline basis, has fallen to 3.1% through November 2023.

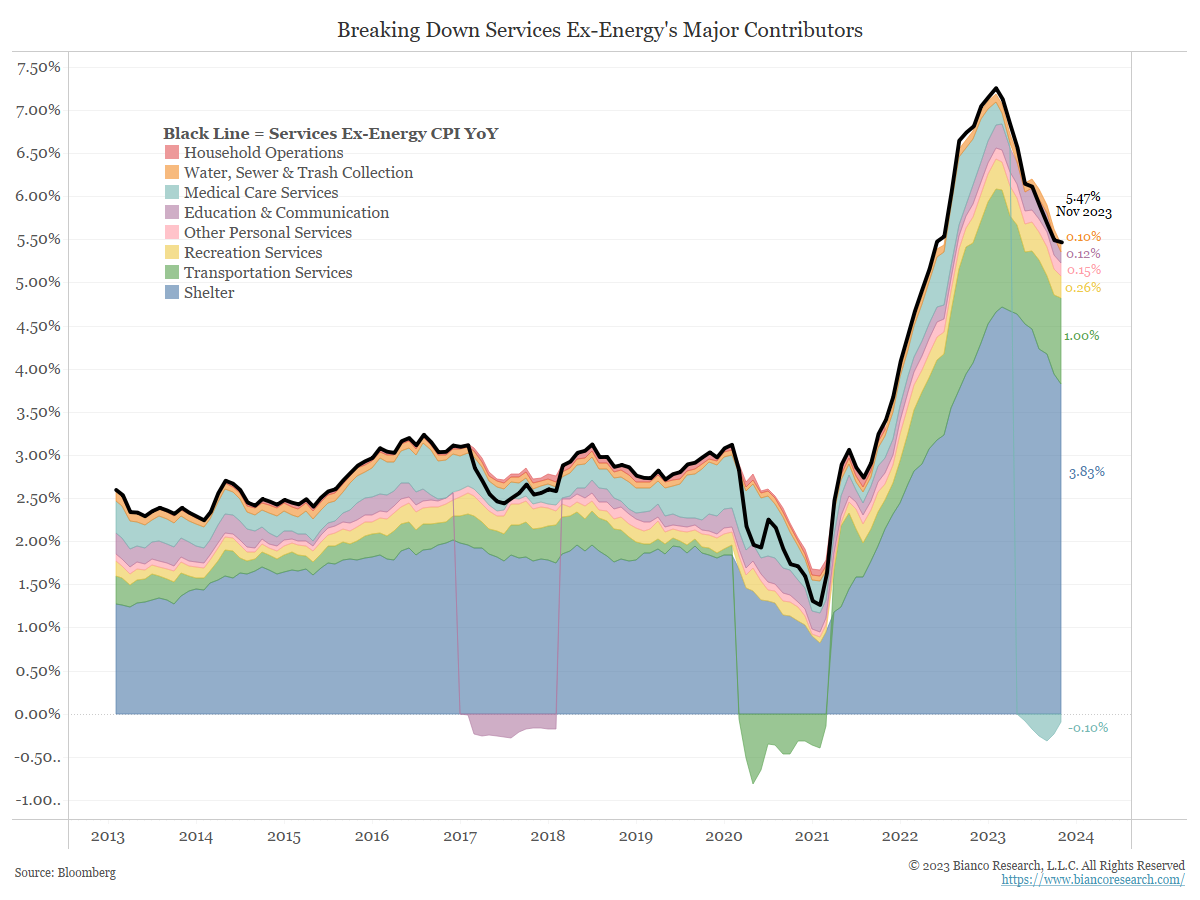

Notice in the chart above that the overwhelming contributor to inflation is services ex-energy (blue). Any meaningful declines in inflation from here on out need to come from services ex-energy, which still contribute much more than their historical norm to headline inflation.

When breaking down the main contributors to services ex-energy inflation, the majority boils down to shelter prices. So, inflation will remain elevated until the shelter component comes down considerably.

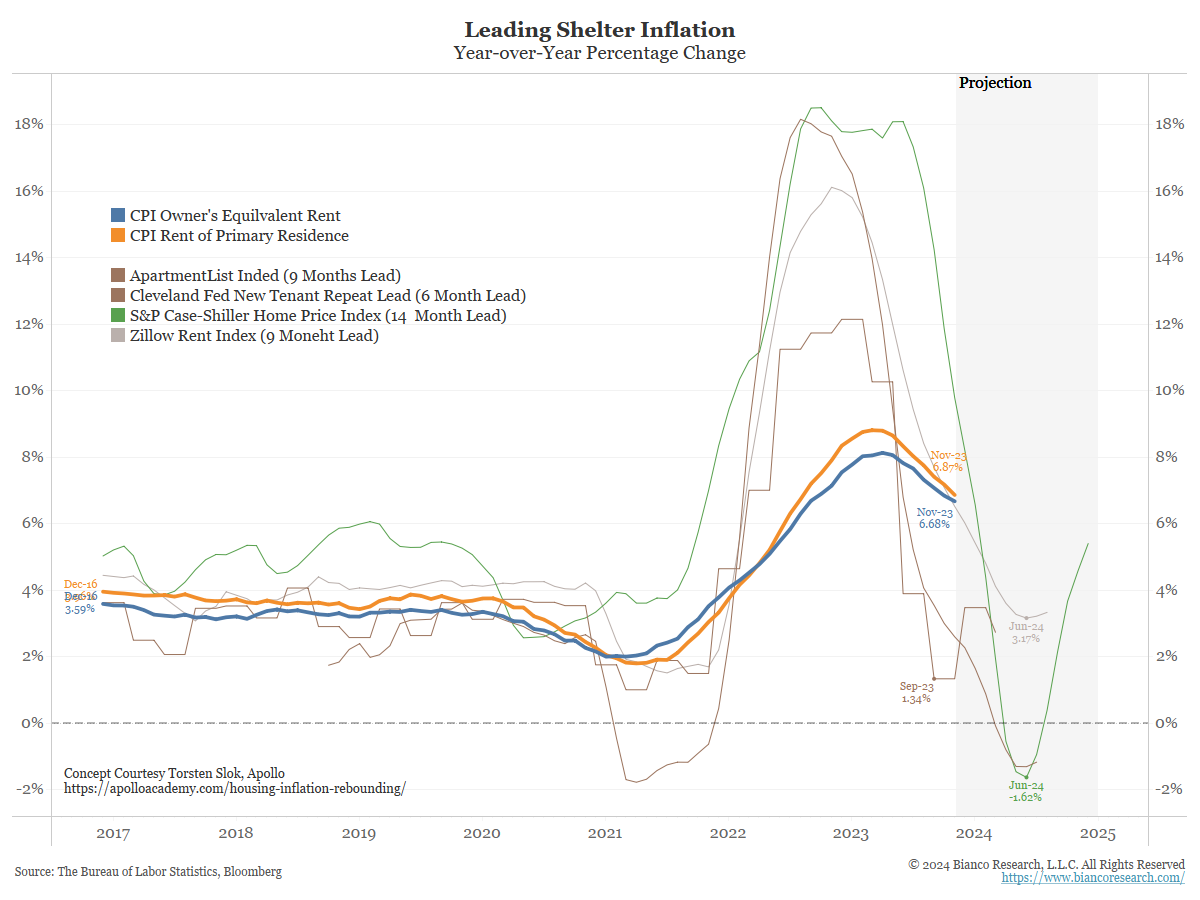

An important note here is that rents outpaced shelter inflation by a significant margin in 2023. The following chart is similar to a concept done by Apollo’s Torsten Slok and shows both Owner’s Equivalent Rent (OER) and Rent of Primary Residence (RPR) compared to various rent metrics shifted ahead by their lead time.

All of the leading rent indicators have bottomed and turned higher.

If you shift these series ahead and use them as a proxy to project the path of CPI OER/RPR, a rebound in rent inflation will likely be in mid-2024.

Now There Is A Yield!

- Reuters – US fintechs push into fixed-income trading as retail investor interest grows

“When you try and do anything in the bond or fixed-income world … it looks and feels 25 years old. We just haven’t, as an industry, invested in that, and I think we are starting to see the fintech world catch up,” said Stephen Sikes, chief operating officer at Public. The New York-based broker-dealer in December announced it would begin offering customers the ability to invest in $100 slices of Treasury and corporate bonds. It plans to add municipal bonds this year and eventually lower that minimum to $10. Sikes said Public’s Treasury account was its most successful product in 2023, as measured by investor flows. Although retail investors have long been able to purchase Treasury bills directly from the Treasury Department or a retail brokerage, the process is cumbersome and often requires a minimum investment of anywhere from $1,000 to $10,000.

Asset Manager Struggles in the UK

- Financial Times – UK fund launches fall to 20-year low

Money has been flooding out of funds in the UK in recent years as soaring inflation and the rising cost of living have pushed retail investors to raid their investment pots — 2022 was the worst on record, with £50bn redeemed on a net basis from funds. Retail and institutional investors pulled a further £37bn in the 10 months to October 2023, according to data from the Investment Association. The outlook for the investment management sector has deteriorated alongside this as the impact of the outflows on asset managers has been compounded by investors’ flight to passive funds, a downward pressure on fees and rising regulatory costs.

Crypto Options

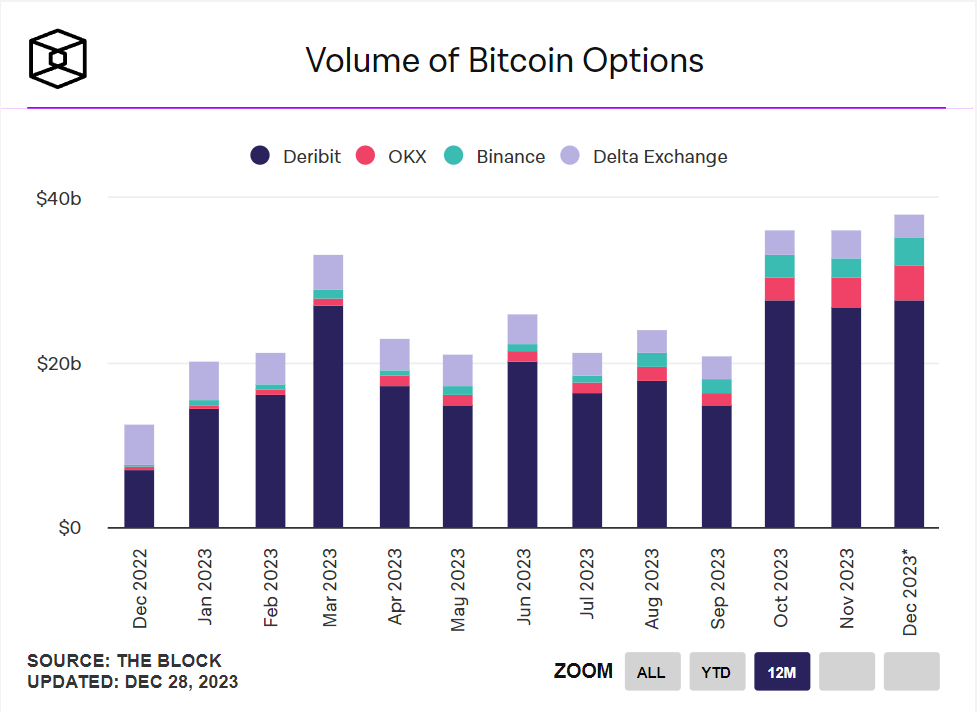

- Bloomberg – Crypto Options Trading Volume Hits Record as ETF Deadline Nears

“We see clients rolling positions to 2024 expiries and expect to see more of that closer to the expiry as well as afterward,” Strijers said. “After the expiry, all eyes and trading activity will be focused on the upcoming ETF decision.” The crypto market has rallied strongly this year, with Bitcoin up almost 160%, after a series of industry scandals sent prices of digital assets plunging in 2022. The recovery was in part driven by optimism that spot Bitcoin ETFs will be approved, attracting a wider range of investors to the asset class. Options give the purchaser of the contracts the right to buy or sell the underlying asset at a specific price within a set time period.

As supply chains become an issue again, a valuable insight is the YouTube Channel “What’s Going On With Shipping.”

Its latest update is here.