Summary

Comment

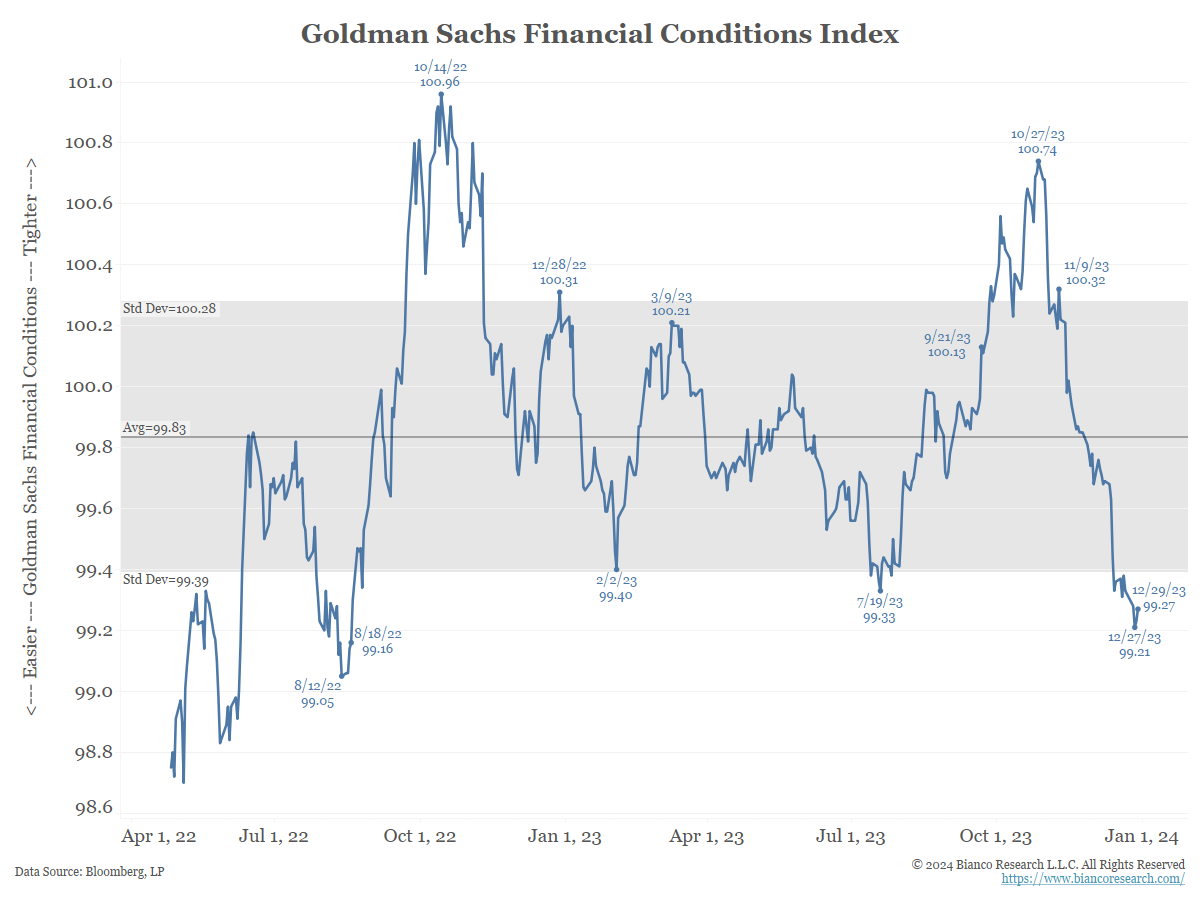

Here are the daily index closes over the last 20 months.

On an absolute basis, financial conditions are the easiest since last August 2022, when Jay Powell delivered his 8-minute speech at Jackson dubbed the “their will pain” speech.

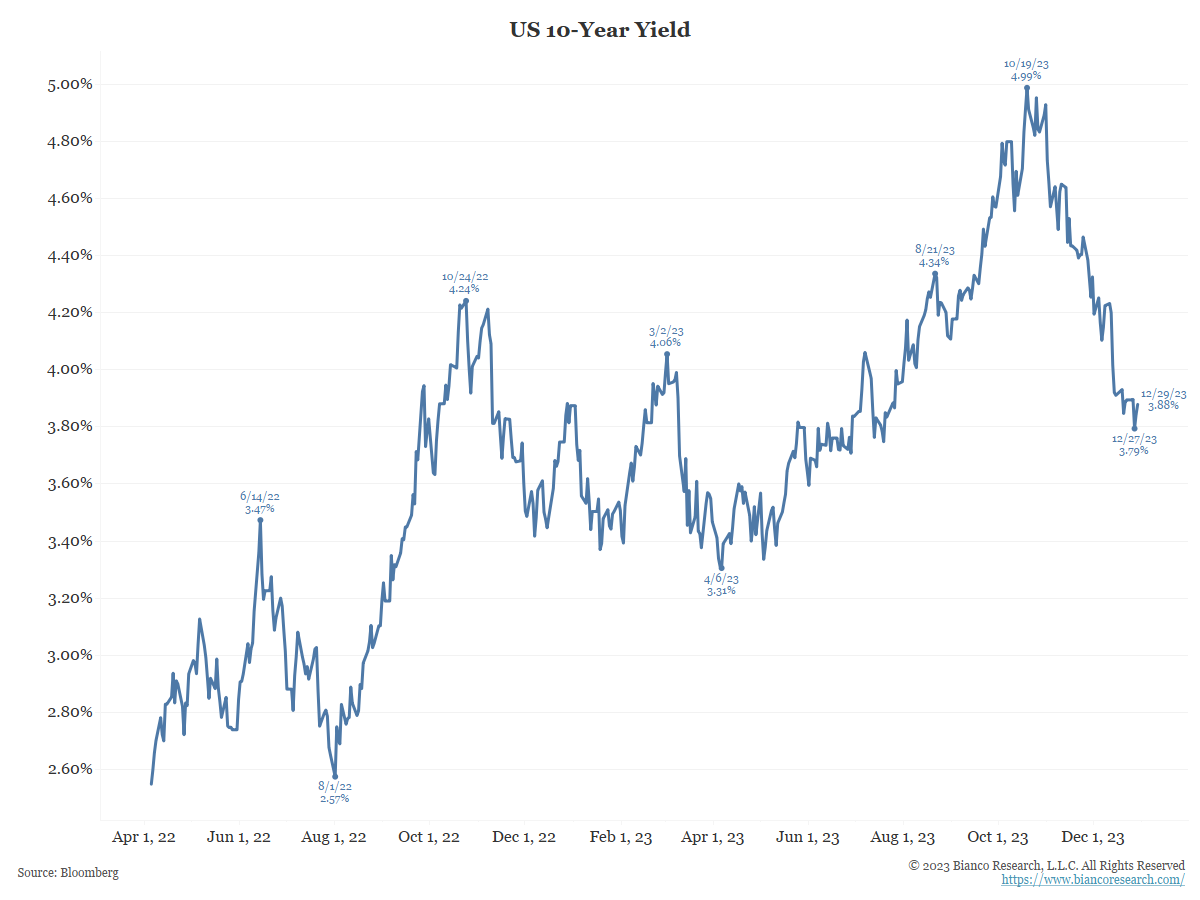

Driving the easing of financial conditions has been the big drop in yields.

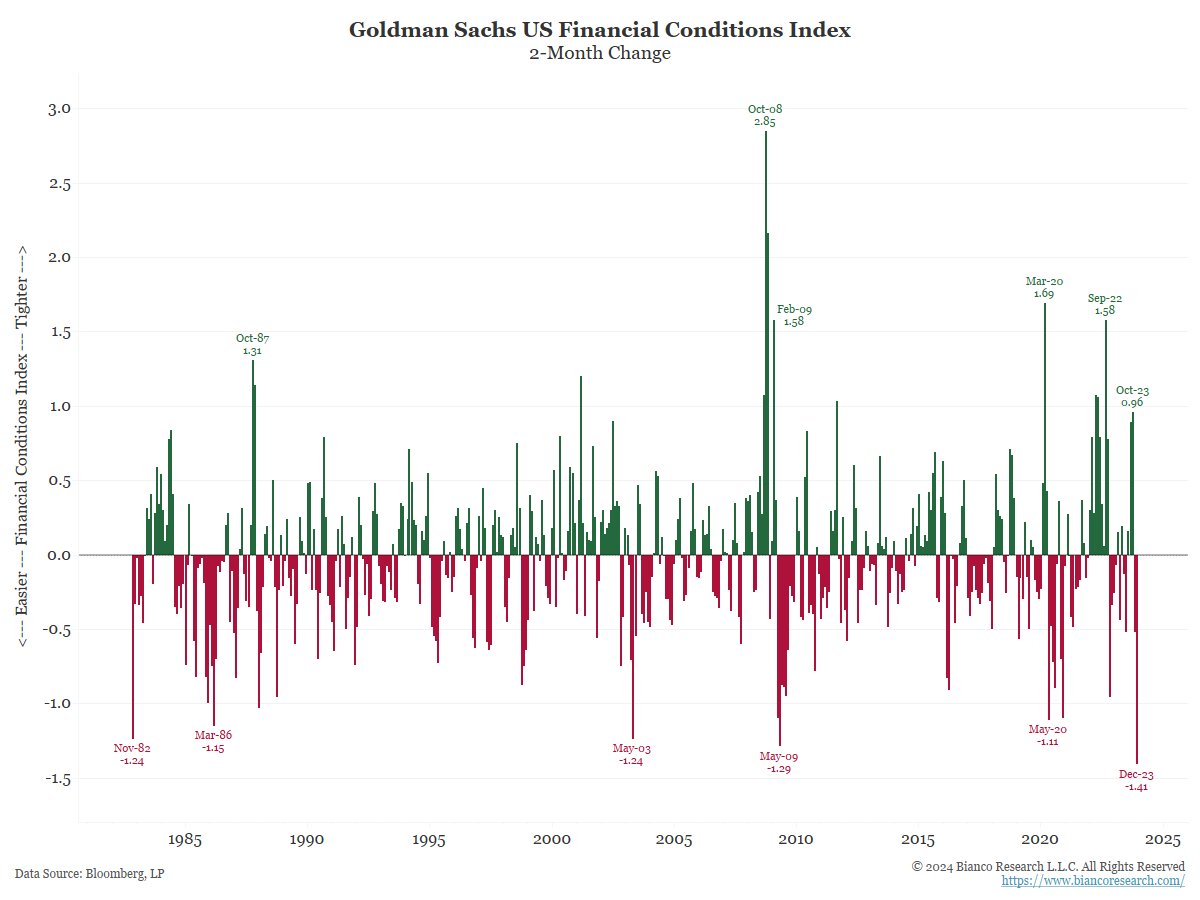

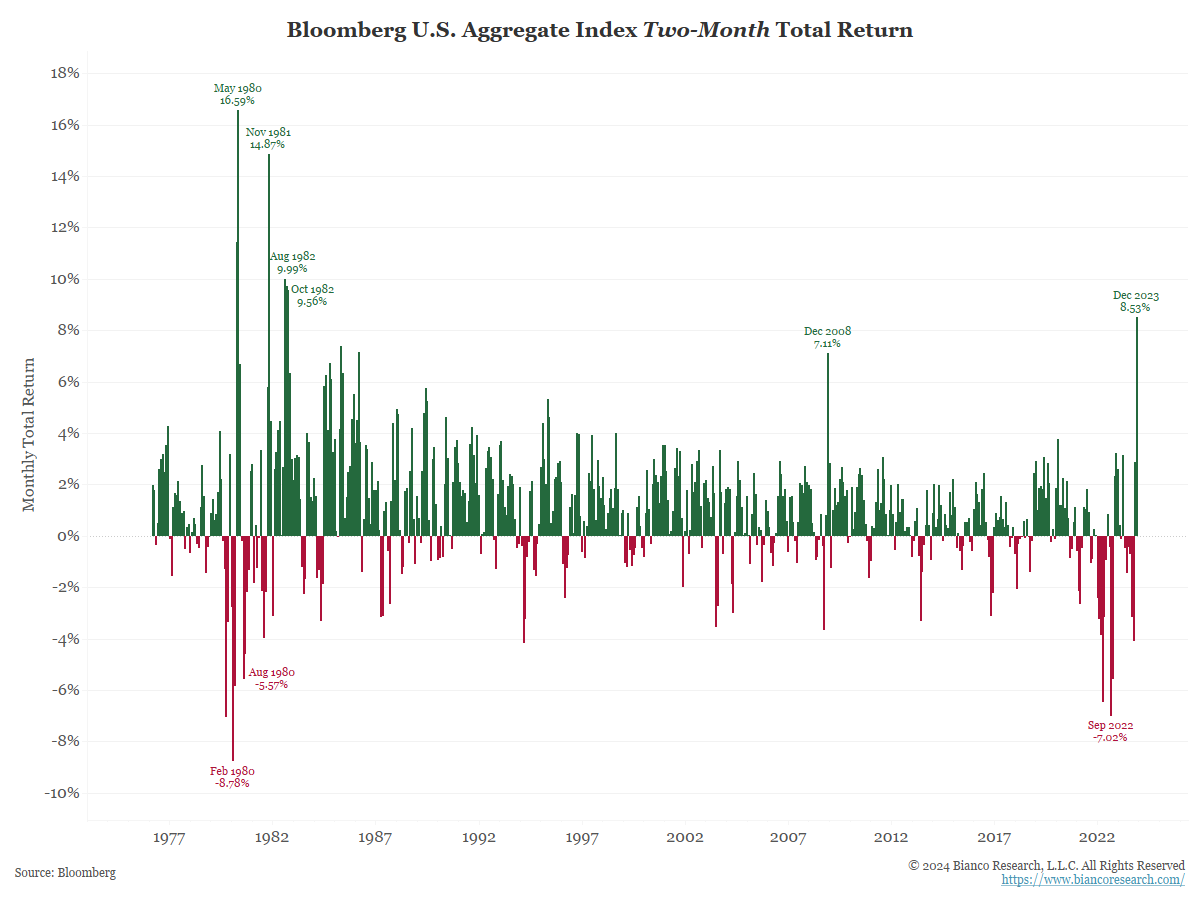

Sparking the bond market’s biggest two-month rally in 40 years.

The question is, how does this impact the economy? First, what is expected?

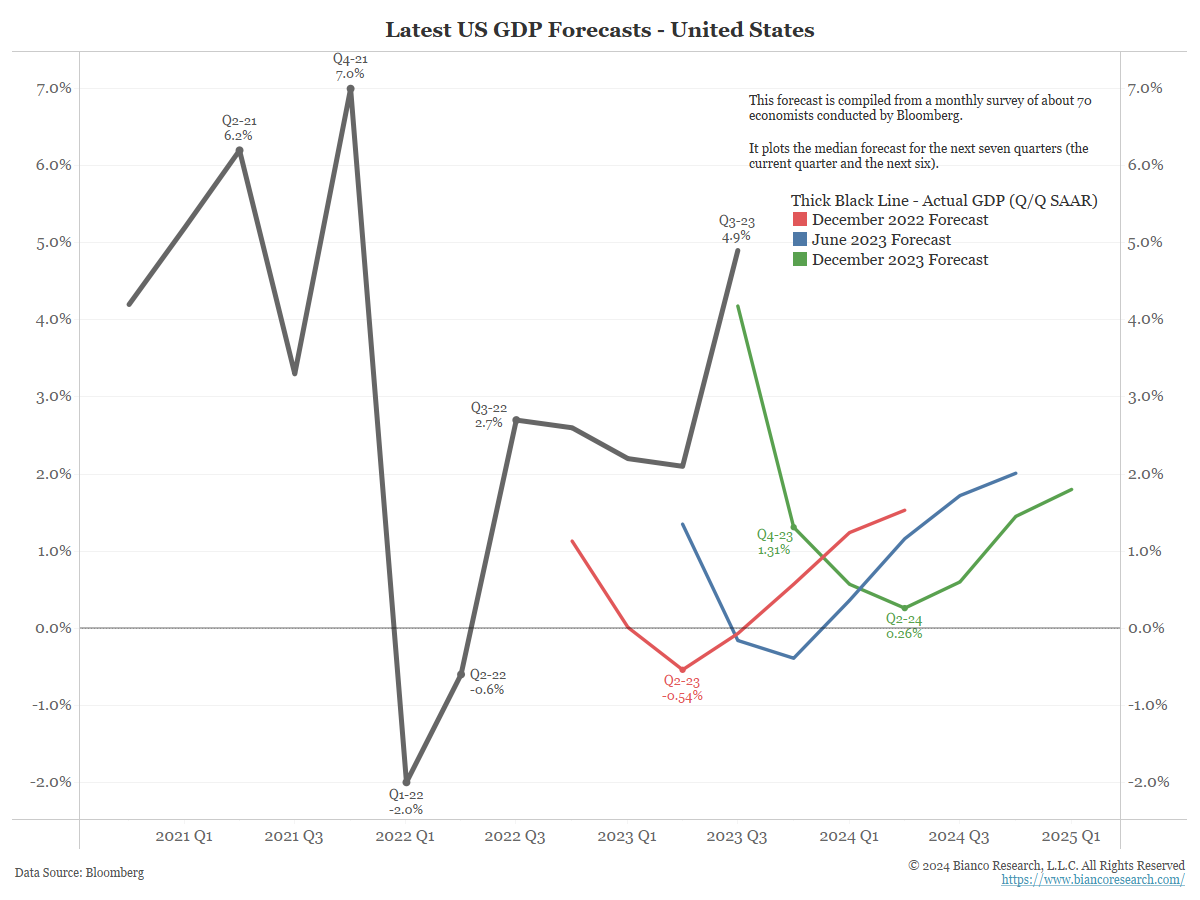

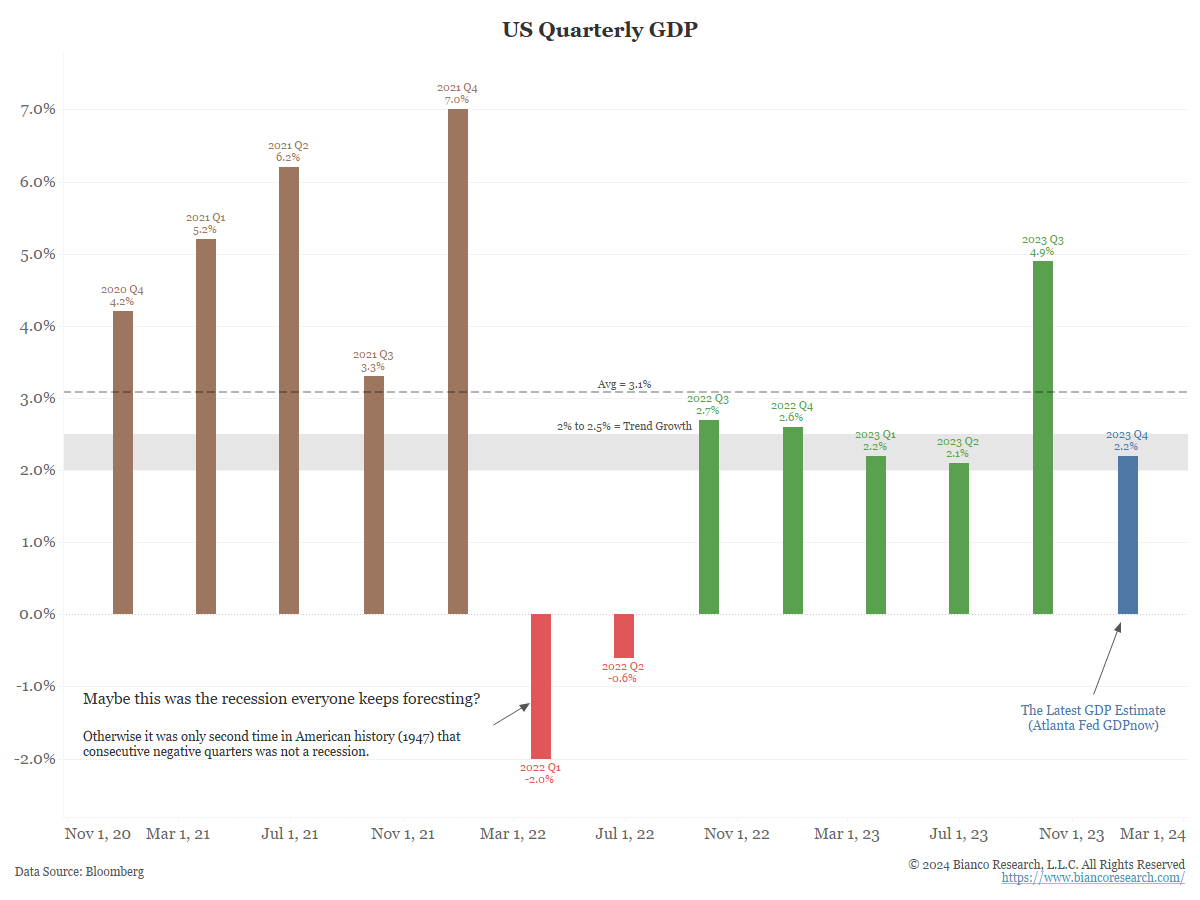

The black line is the actual GDP through Q3 2023, booming at 4.9%.

The three colored lines come from a survey of about 70 economists by Bloomberg. It plots the median forecast for the subsequent six quarters of real GDP. Shown are the December 2022 (red), June 2023 (blue), and December 2023 (green) median forecasts.

The street consensus is a significant pullback in the economy, a.k.a. a “soft landing.”

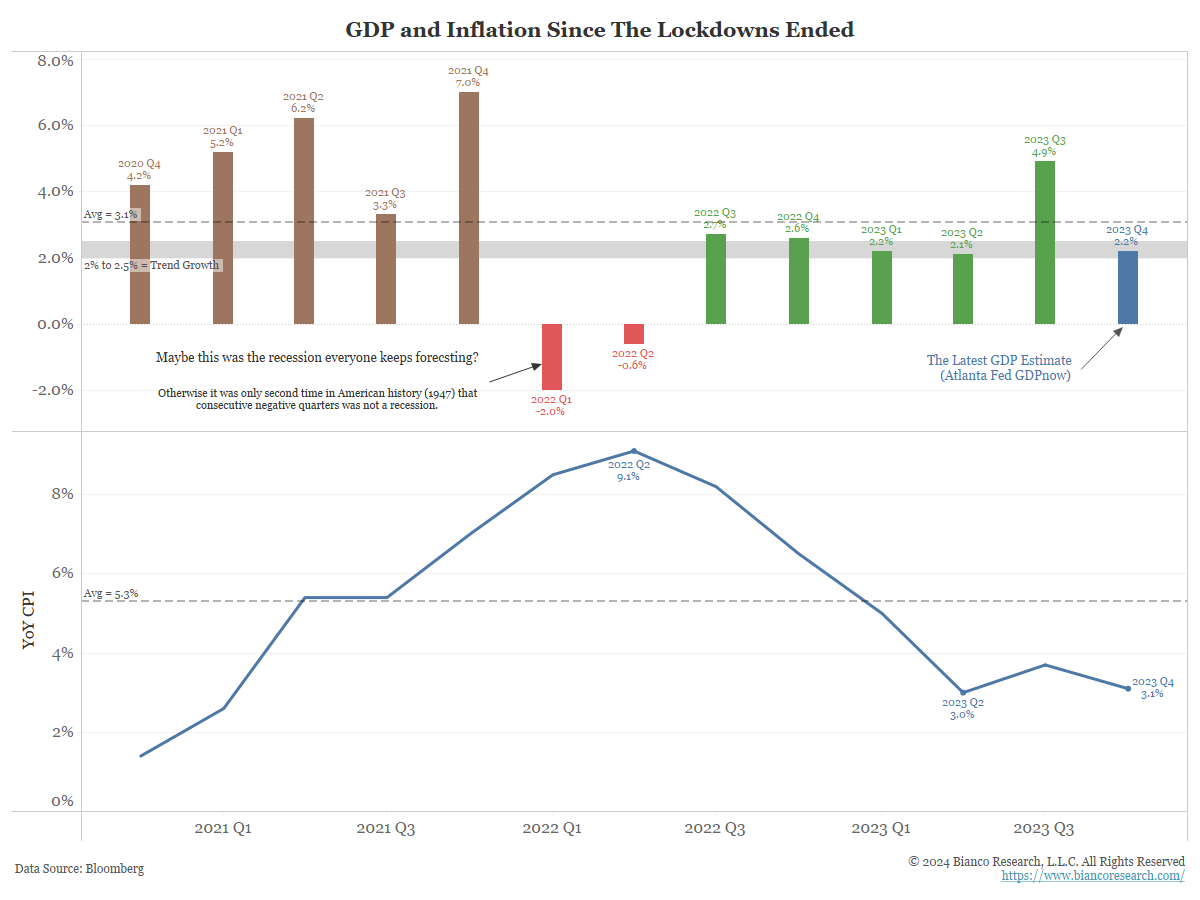

But a soft landing is not happening. The latest Atlanta Fed GDPnow estimate is 2.2% for Q4 2023 growth (blue bar).

Quarterly GDP has averaged well above the trend of 3.3% (dashed line) since late 2020 (the last 13 quarters). Over the same period, year-over-year CPI has averaged 5.4%.

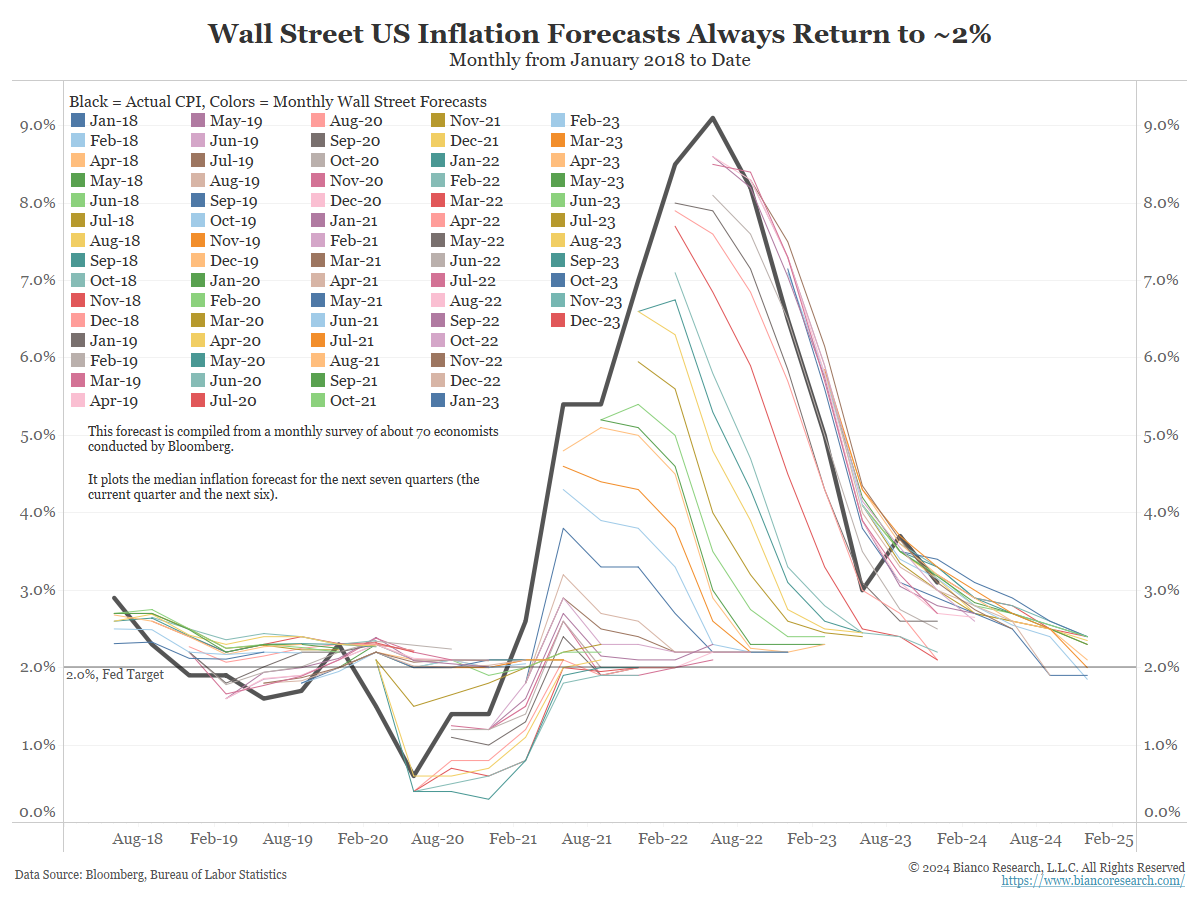

And if the soft landing does not happen, will the perpetual forecast for transitory inflation (all the falling inflation forecasts, the colored lines, for the last five years) be itself “transitory” in the face of trend to above-trend growth?

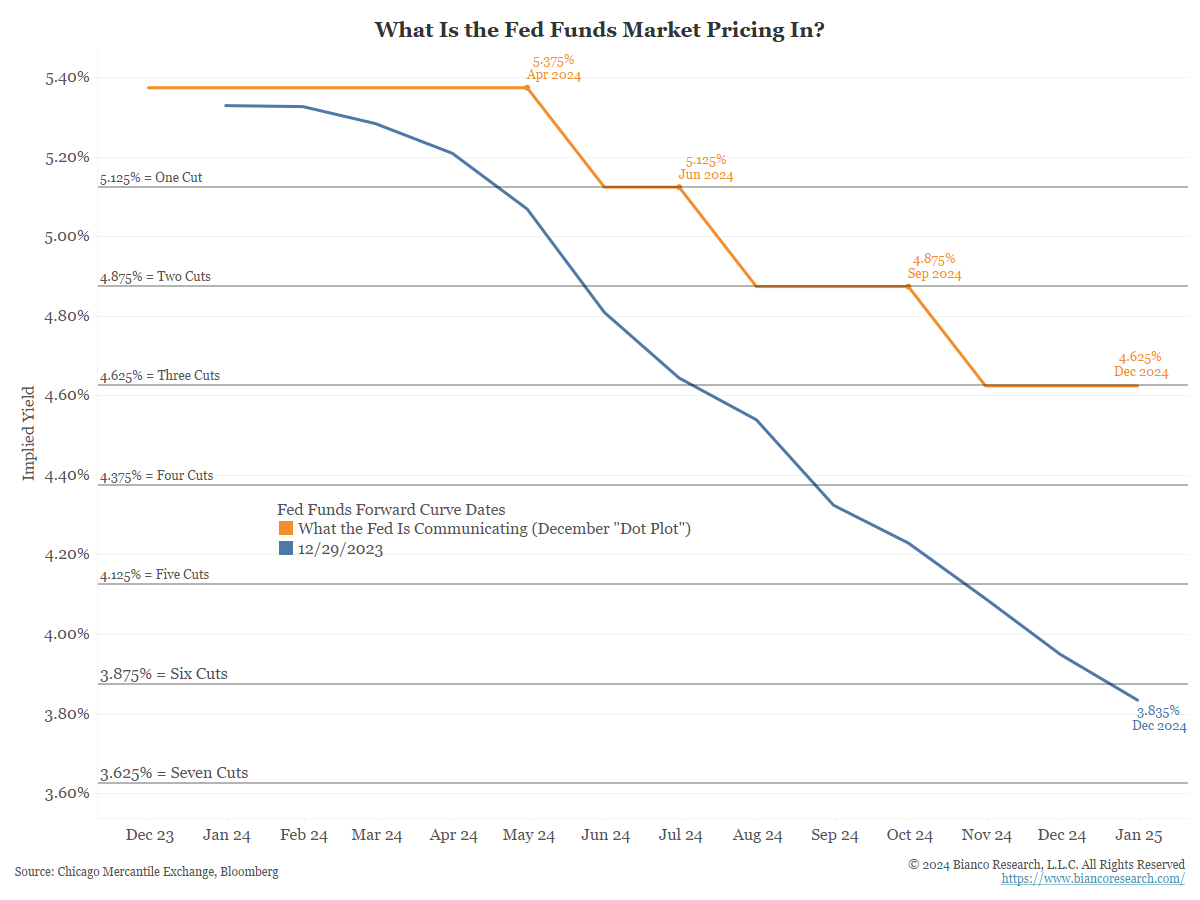

And with it, the hope that the Fed will cut rates at least six times in 2024.

So, back to our question:

What do big increases in brokerage statements and Zillow home price estimates (because of falling mortgage rates) over the last two months mean for the economy in 2024?

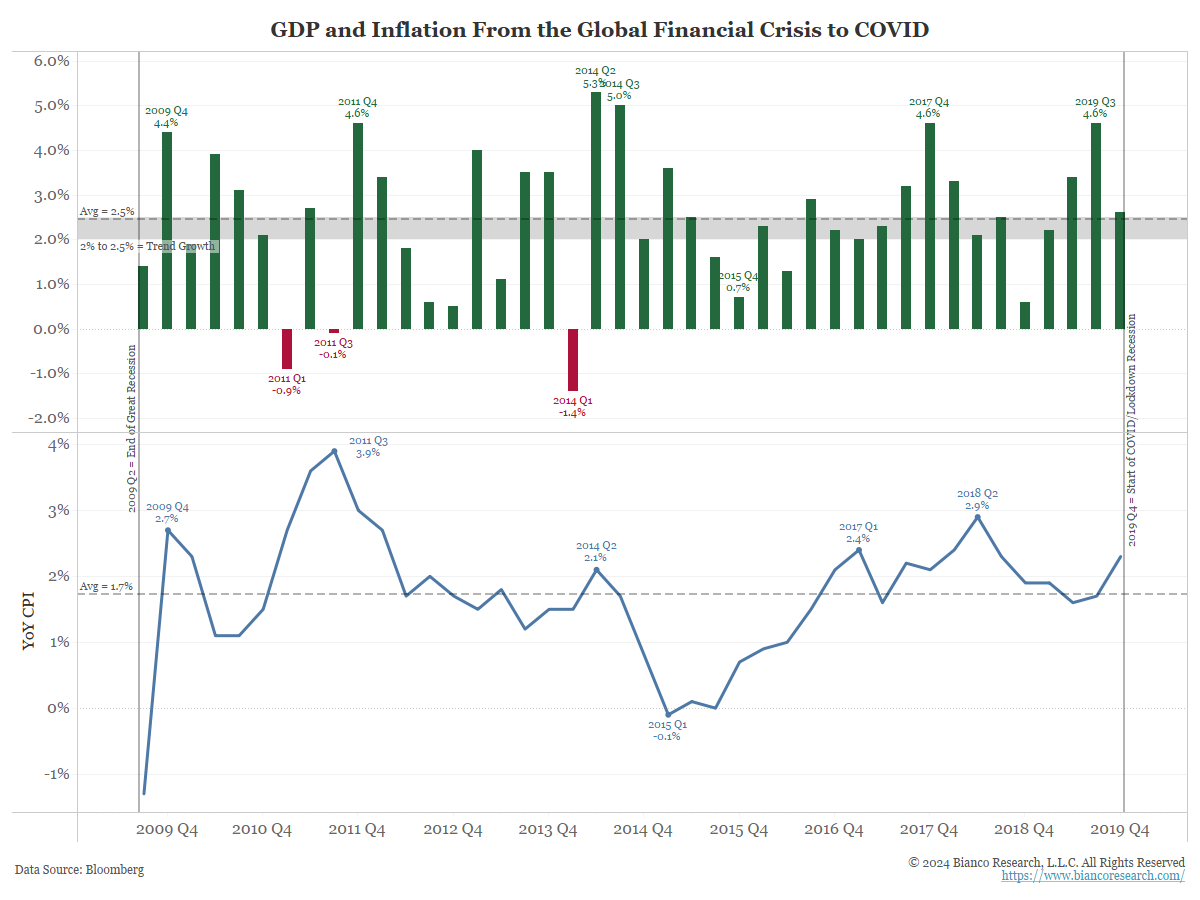

Is this like 2009 to 2020, when people were thrilled at the rise in wealth but did not spend it as they prioritized increasing savings? Consequently, the strong financial conditions during this decade (including a 200+ year low in yields) only translated into GDP averaging a trend level of 2.5% and inflation averaging below the Fed 2% target of 1.7%.

Does anyone remember that during 2020/2021, 89% of new cars sold for over sticker price, contributing to 9% inflation by June 2022?

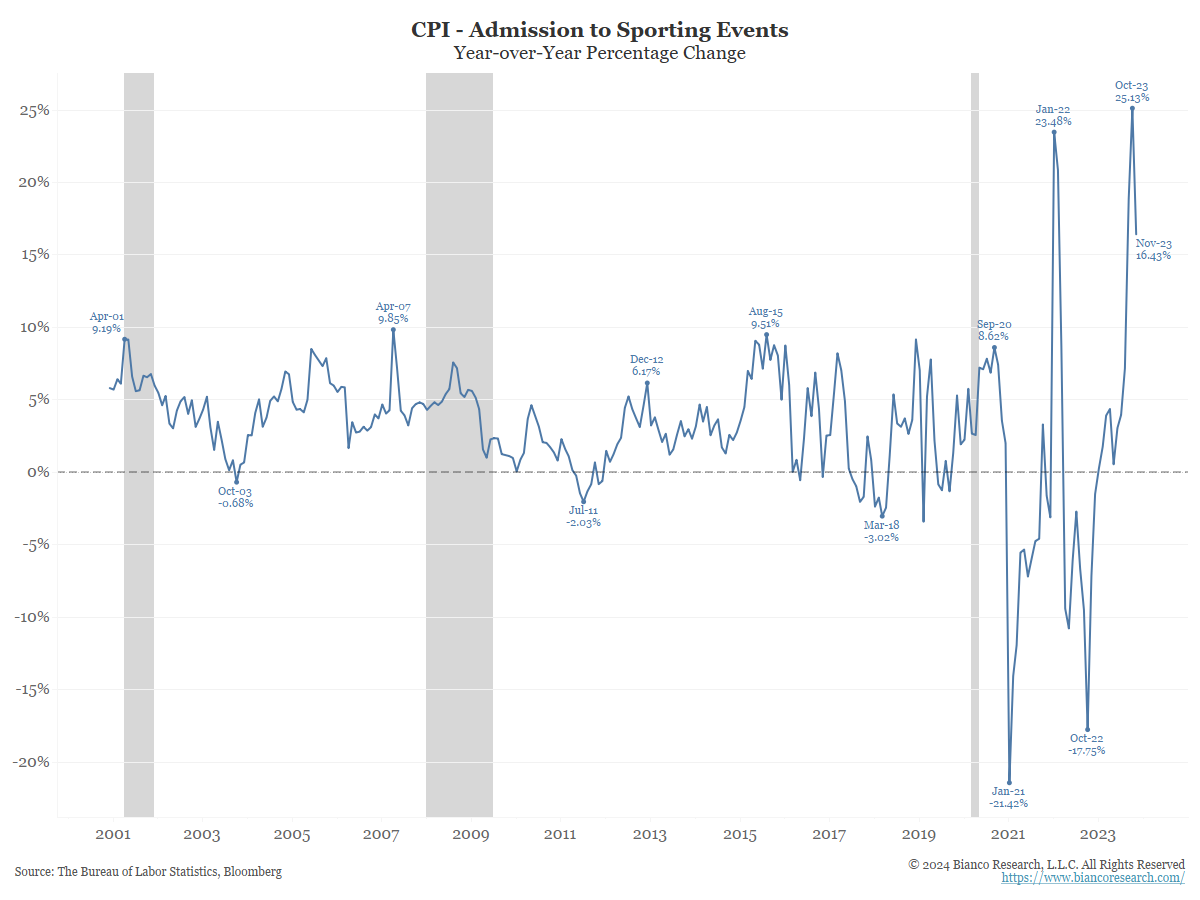

Something equivalent today might be sports tickets, the ultimate discretionary purchase (meaning you don’t need it but really want it). Ticket prices are booming to record yearly increases, even more than when sports venues reopened to fans in January 2022, and insatiable demand to get out of the house sent their prices soaring.

And this does not include Taylor Swift tickets!

Conclusion

We lean toward another episode similar to 2020/2021, meaning easing financial conditions will lead to stronger growth and “stickier” inflation.

And to be clear, “sticky” inflation means year-over-year CPI bottoms near 3%, or current levels and trends higher toward 4%. Not a return to 9%.

But this will be a problem for a street pricing in six Fed cuts, and a Fed committed to inflation returning to 2%.